Trowe price aum

We use cookies on this site to provide a more responsive and personalized service. Continuing to browse, clicking I Agree, or closing this banner indicates agreement.

Rowe Price Group, Inc. The firm was founded in by Thomas Rowe Price, Jr. As of , the company is focused on active management after strategically deciding against a major initiative in passive investment. Consistently ranked among the world's top asset managers, T. Thomas Rowe Price Jr. When he founded T. He became well known as the "father of growth investing" and was nicknamed the "Sage of Baltimore" by Forbes.

Trowe price aum

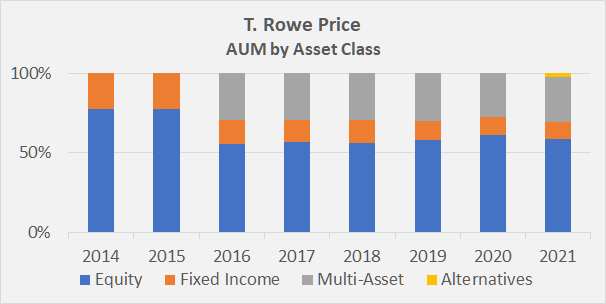

Rowe Price remains an adaptable, trustworthy steward of capital, earning a High Parent rating. To address this challenge, the firm split into two distinct research entities in March Six strategies, including five capacity-constrained equity strategies, moved to the new division, T. Rowe Price Investment Management, while the rest of the firm now exists as T. Rowe Price Associates. From to , the firm bolstered its topnotch equity analyst team with new hires to fortify each division's research resources and ensure an orderly transition. Rowe Price added to its array of offerings by acquiring alternative credit specialist Oak Hill Advisors in Rowe has seldom grown inorganically, but the move expanded its capabilities and helped diversify its asset base. Equities remain T. Rowe's strength. It would like to grow its fixed-income business, though that segment remains a step behind peers; it only recently hired dedicated risk personnel in that area.

TROW stock data.

After medical school in the UK, I worked as an emergency room doctor. What drew me to capital allocation in health sciences was the potential to help many people for years to come through investments that help fund medical innovation. The human body is made up of proteins. Any disease caused by too much of a bad protein can be controlled or cured by blocking protein production at the cellular level. Risks: All investments are subject to risks, including the possible loss of principal. Health Science stocks face special risks, including adverse legal or regulatory developments, patent expirations, market competition, and rapidly changing industry dynamics. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision.

Partner with a firm that puts you first. Prefer to talk first? Call By remaining true to our guiding principles and strategic investing approach, we believe we can deliver the consistent, competitive performance you need to achieve your most important financial goals. Since , strategic investing has guided how we uncover opportunities for our clients. See how our investment professionals go beyond the numbers and into the field to get the full story for your investments. Explore the array of complimentary services and resources we offer to help you make informed investment decisions— and make the most of your money. As your assets with us increase, so will your benefits.

Trowe price aum

Rowe Price Group, Inc. However, the bottom line decreased 1. A decline in expenses aided bottom-line growth. Further, appreciation in cash and cash equivalents will help the company to continue investing. Net income attributable to T.

Taraftaryum

Rowe Price Press Release, April Rowe Price Advisory Services, Inc. Helping investors thrive in an evolving world. Home Products Products. Sign in to manage subscriptions for products, insights and email updates. As of , the company is focused on active management after strategically deciding against a major initiative in passive investment. See our Cookie Policy for more information. All data as of 31 December , unless otherwise noted. Wells Fargo Maintains Underweight on T. Registration incomplete. After medical school in the UK, I worked as an emergency room doctor. Learn More. Consistently ranked among the world's top asset managers, T. Download Latest Date Range. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision.

.

The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price remains an adaptable, trustworthy steward of capital, earning a High Parent rating. Baltimore portal Category. New York Times. Please kindly confirm your email address to complete your subscription and start receiving email updates. Five years later, we launch our first dedicated emerging markets strategy in Investment Flows TTM 1. Download as PDF Printable version. No document available. Rowe Price's impressive bench of investment talent, prudent corporate management, and relatively low fees continue to give it an advantage. Nothing in this website shall be considered a solicitation to buy or an offer to sell a security, or any other product or service, to any person in any jurisdiction where such offer, solicitation, purchase or sale would be unlawful under the laws of such jurisdiction. Rowe Price Canada , Inc.

My God! Well and well!

I think, that you are not right. I am assured. I can defend the position. Write to me in PM, we will talk.

You have hit the mark. In it something is also to me your idea is pleasant. I suggest to take out for the general discussion.