Tsla stock forecast 2024

Even as it may appear the dust has settled, one can make a convincing argument on either side tsla stock forecast 2024 where TSLA is headed from here. On one hand, plenty of strong long-term catalysts remain in motion. In time, they could help assuage key concerns at present. On the other hand, momentum could funnyplaying on the side of the skeptics.

In the unfolding narrative of , Tesla Inc. NASDAQ: TSLA continues to ride the waves of market dynamics, showcasing resilience, innovation, and the inherent challenges of maintaining a pioneering stance in the ever-evolving electric vehicle EV sector. The embers of optimism for a robust are fueled further by the much-anticipated unveilings of the Cybertruck and Tesla Semi, aligning with a balanced price-to-earnings narrative, a tableau echoed across market analysts. As Tesla's innovative pulse continues to disrupt the automotive status quo, the federal incentives rolled out for new clean vehicles in or beyond add a favorable wind to Tesla's sails, potentially enticing a broader consumer base to embrace the electric drive. With the stock market's heartbeat resonating positively with Tesla's operational and financial maneuvers so far in , the narrative of Tesla continues to be a riveting blend of innovation, trading realities, and the undying quest for electric mobility supremacy. As we delve deeper into the Tesla history in , the market awaits with bated breath the unfolding chapters of Tesla's journey, the resonance of its stock performance, and the broader impact of its innovative strides in an industry standing at the cusp of the electric revolution.

Tsla stock forecast 2024

.

However, the broad spectrum of price projections from different experts underscores a high degree of uncertainty and divergent opinions regarding Tesla's future performance. By fortifying its balance sheet and tsla stock forecast 2024 in operations, Tesla aims to accelerate past competitors and deliver full self-driving capabilities.

.

Tesla closed out with a bang, reporting record deliveries for a calendar year and eclipsing the 1. Now, is here, and analysts are putting into scope what could come from Tesla this year. Tesla will also look to ramp up production of the Cybertruck this year. Tesla Model 3 Highland delivery from Fremont expected by the end of Q1 Analysts are split on what they expect from Tesla in , while the bulls are being bulls and the bears are being bears. What else should we expect, right? Inversely, we will also look at the more pessimistic analysts, and why they feel could be the most challenging year for Tesla yet.

Tsla stock forecast 2024

Every car company is now mass producing electric vehicles. Tesla must maintain its margins in the face of that global competition to maintain its market cap. It can dance, and in a year, it will thread a needle, he insists.

Timify

In the meantime, between now and when the first EV sector green shoots emerge, TSLA could stay on a downward trajectory. Medium-term fundamental analysis. From January , we saw a long upward trend, which formed new highs for two years. In the unfolding narrative of , Tesla Inc. We analyzed projections from top research firms to compile a monthly price target forecast for Tesla through Previously, I have talked about how hitting two milestones could kick off the next boom for TSLA stock. Gov Capital's accuracy track record for long-term forecasts needs to be clarified. Rather than play guessing games, they focus on Tesla's addressable markets, sustainable competitive advantages, and capital allocation savvy. On one hand, plenty of strong long-term catalysts remain in motion. With vast addressable markets still untapped, Tesla remains an attractive long-term investment. By taking these factors into account, you can gain a more comprehensive perspective on the potential price movement of Tesla shares over the coming week. Analysts have mixed reviews; some are bullish, anticipating price growth, while others foresee potential downside due to various risks. Opinions differ on this matter.

With the New Year less than two weeks away, at the time of publication, Finbold decided to see what Wall Street analysts are forecasting for the EV giant, as well as who some of its biggest bulls and bears are. Bernstein analysts also back their prognosis by pointing toward market saturation and the ever-increasing competition in the EV industry. They conclude that much like Tesla had to implement price cuts in to keep up, it will have to reduce the cost of its vehicles even more in

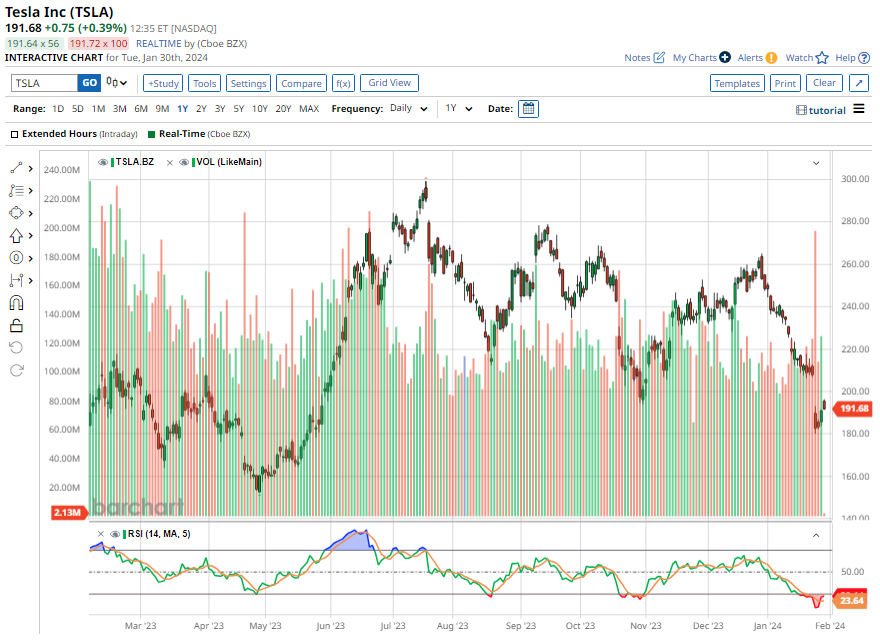

The embers of optimism for a robust are fueled further by the much-anticipated unveilings of the Cybertruck and Tesla Semi, aligning with a balanced price-to-earnings narrative, a tableau echoed across market analysts. Historically, Tesla's stock performance has been characterized by substantial volatility , a trend likely to continue given the speculative nature of the EV market. Tesla's meteoric rise has sparked heated debate about how high the company's shares can climb in the coming years. Musk is determined to steer the company toward a future where Tesla dominates the road. Gov Capital's accuracy track record for long-term forecasts needs to be clarified. As the electric vehicle maker continues ramping production and expanding into new regions, forecasts for where the stock heads next vary widely. LiteFinance provides detailed analysis and predictions on the US Dollar to Canadian Dollar exchange rate to help you make informed financial decisions. Monthly price targets for TSLA stock range from bullish heights to bearish lows based on shifting opinions of future profits. So, is it time to buy, sell, or hold? Gov Capital projects upside potential for Tesla stock through driven by growth catalysts, though the forecast comes with execution and competition risks. In the meantime, between now and when the first EV sector green shoots emerge, TSLA could stay on a downward trajectory. Yet, there are substantial risks, including execution challenges, production delays, fierce competition from traditional automakers transitioning to EV production, and concerns regarding high valuation. However, the bears point to risks around production setbacks, competition, and Tesla's steep valuation. As Tesla charges ahead, few would bet against Elon Musk continuing to prove the naysayers wrong. Looking at the history of the exchange rate movements, you can see that all past price declines also occurred after publications of financial reports.

What matchless topic

I well understand it. I can help with the question decision. Together we can find the decision.