Ubank daily limit

This website doesn't support your browser and may impact your experience.

Here are the answers to frequently asked questions about transferring money online. For international transfers, go to international accounts FAQs. In most cases, transfers between your accounts will go through immediately. However, please allow one working day for transactions to be processed. You can schedule a transfer up to 24 months in advance. You can also set up regular payments daily, weekly, fortnightly or monthly for up to 24 months in advance.

Ubank daily limit

Your browser version is no longer supported, so you may experience issues while using this site. Please upgrade to a current browser to enjoy the best experience. To protect your account, we limit the amount you can send via Internet Banking and the Suncorp App. Payments between your own Suncorp Accounts are not subject to daily limits or transaction limits except when using PayID. You'll need to register for the Suncorp Secured App before you can change your daily limit in Internet Banking. To keep your account secure, Security Token Codes will expire after 60 seconds. Select your new daily limit from the drop-down menu. Agree to the terms and conditions and your new Daily Limit will now be active until you change it or deregister from the Suncorp Secured App. Remember, changing your daily limit has no effect on your transaction limit. You'll need to register for the Suncorp Secured App before you can generate a Security Token Code to authorise a payment. Business accounts are subject to the standard online transaction limits , daily limits and international transfer limits. However, business accounts can choose to add additional limits in the form of account limits and personal limits. An account limit is the maximum amount that can be debited from your business account each day regardless of how many registered users are listed on the account.

Enter a name for each deposit at the ATM and review the total before finalising, ubank daily limit. Once it is processed, you will have access to this function the next time you log on to Internet Banking. Transfer fees deducted by any other banks involved in the money transfer in any currency In order to facilitate your payment, other banks may ubank daily limit the payment or impose additional fees or fuqlist.

If you love the convenience of everyday banking with your smartphone, then look no further than the Spend Account from ubank. Because the Spend Account is completely app-based and accessible only through an iOS or Android app, it doesn't offer any branch access, so it will suit users who prefer to do their banking on their smartphone rather than through a traditional brick and mortar bank. The ubank card could also be a handy travel companion, as it gives you access to international ATMs at no extra cost ATM provider fees may apply though and you'll be able to make international transactions — whether that's on holiday overseas or during an online shopping spree — without a fee! The Spend Account is a good choice for tech-savvy Aussies who want to bank and make transactions with their smartphone and digital wallets, without having to worry about any pesky monthly service fees. I have had nothing but good experiences with my bank from word go they have been very helpful when i needed them so thanks ubank i dont get atm fee or anything. Interest rate on savings is the best without having to jump through various hoops.

Just about every bank puts a limit on how much cash you can withdraw each day. In part, this is a security feature to prevent thieves from cleaning out unauthorized accounts. In other part, this helps banks and ATMs to stabilize liquidity. A daily withdrawal limit is the maximum amount of money you can withdraw from your bank account in a single day. These limits largely exist for two reasons. The first is to manage cash flow and liquidity. Banks keep a limited amount of cash on hand at any given time, as do ATMs. By setting withdrawal limits, the bank can control how much they have to distribute at any given time. Just as importantly, if not more so, withdrawal limits are a security feature. By limiting daily withdrawals, banks help protect their customers against unauthorized access.

Ubank daily limit

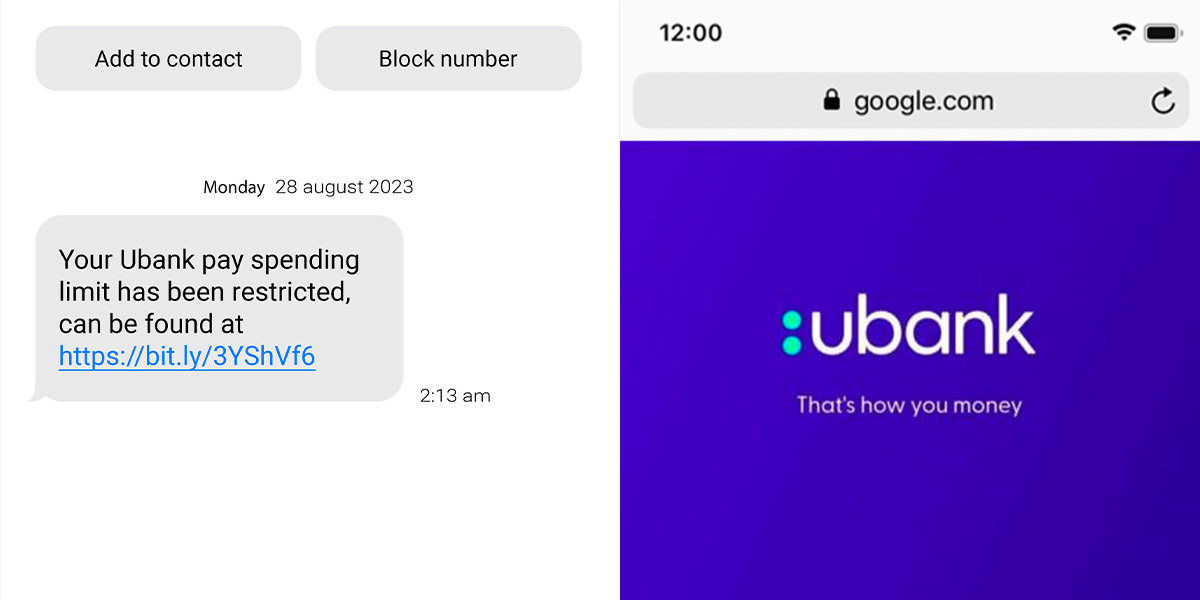

Scams and fraud are a rising global challenge and Australians are seeing a continued increase in the number and type of scams. Never share online banking or app passwords or passcodes with anyone including someone on a phone call and avoid writing them down. Always remember, if it seems weird, it probably is.

Multimeter amazon

In order to facilitate your payment, other banks may convert the payment or impose additional fees or charges. To accounts in Australia: Can I transfer to somebody else's account or to my own account at another bank? With a quick decision our home loans will put you on the financial fast track. Personal Banking. Your daily limit will reset at approximately midnight AEST each day. Speak to a banker if you need help managing your money when travelling abroad. Your browser version is no longer supported, so you may experience issues while using this site. Find your nearest one at ATM locations. If a NAB ATM has retained your card, or if you wish to report a fault, call , 24 hours a day, 7 days per week. Update your browser. Interest rates are applicable at the time of loan approval and are based on the loan to value ratio LVR. Read our Terms and Conditions for more information relating to this. If you wish to edit a Payee account, you'll need to delete it and create a new one. The Spend Account is a good choice for tech-savvy Aussies who want to bank and make transactions with their smartphone and digital wallets, without having to worry about any pesky monthly service fees. I have had nothing but good experiences with my bank from word go they have been very helpful when i needed them so thanks ubank i dont get atm fee or anything Read full review.

.

Terms and conditions apply and are available on request. You do not pay any extra for using our service. Comparison rates for variable interest only loans are based on an initial 5 year interest only period. See your money in one place and track your spending to stay on top. Account limits An account limit is the maximum amount that can be debited from your business account each day regardless of how many registered users are listed on the account. Cheques generally clear in three working days. Business Banking. James, Victoria reviewed about 2 months ago. Print a mini statement. The two balances that appear on your account details screen are your current and available balance. Update your browser. The staff are friendly and take the time to ensure you have what you need. Variable rates from 6.

I am sorry, that has interfered... At me a similar situation. Is ready to help.