Vanguard global bond

Financial Times Close. Search the FT Search. Show more World link World.

Average annual returns at month and quarter end display for the most recent one year, three year, five year, ten year and since inception ranges. Monthly, quarterly, annual, and cumulative performance is also available in additional chart tabs. The performance of an index is not an exact representation of any particular investment as you cannot invest directly in an index. The performance of the index does not reflect the deduction of any expenses which would have reduced total returns. If the Vanguard ETF had incurred all expenses, investment returns would have been reduced. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns.

Vanguard global bond

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested. The performance of an index is not an exact representation of any particular investment as you cannot invest directly in an index. The performance of the index reflects the reinvestment of Distribution and dividends but does not reflect the deduction of any fees or expenses which would have reduced total returns. Figures for periods of less than one year are cumulative returns. All other figures represent average annual returns. Performance figures include the reinvestment of all dividends and any capital gains distributions. The performance data does not take account of the commissions and costs incurred in the issue and redemption of shares. Sorry, this information is not available yet. It will display a year after inception date. Please note Beta and R-squared data will only display for funds with 3 full years of history. The allocations are subject to circumstances such as timing differences between trade and settlement dates of underlying securities, that may result in negative weightings.

Show more Opinion link Opinion. This table shows risk and volatility data for the Fund and Benchmark.

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested. The performance of an index is not an exact representation of any particular investment as you cannot invest directly in an index. The performance of the index reflects the reinvestment of Distribution and dividends but does not reflect the deduction of any fees or expenses which would have reduced total returns. Figures for periods of less than one year are cumulative returns. All other figures represent average annual returns. Performance figures include the reinvestment of all dividends and any capital gains distributions. The performance data does not take account of the commissions and costs incurred in the issue and redemption of shares.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies.

Vanguard global bond

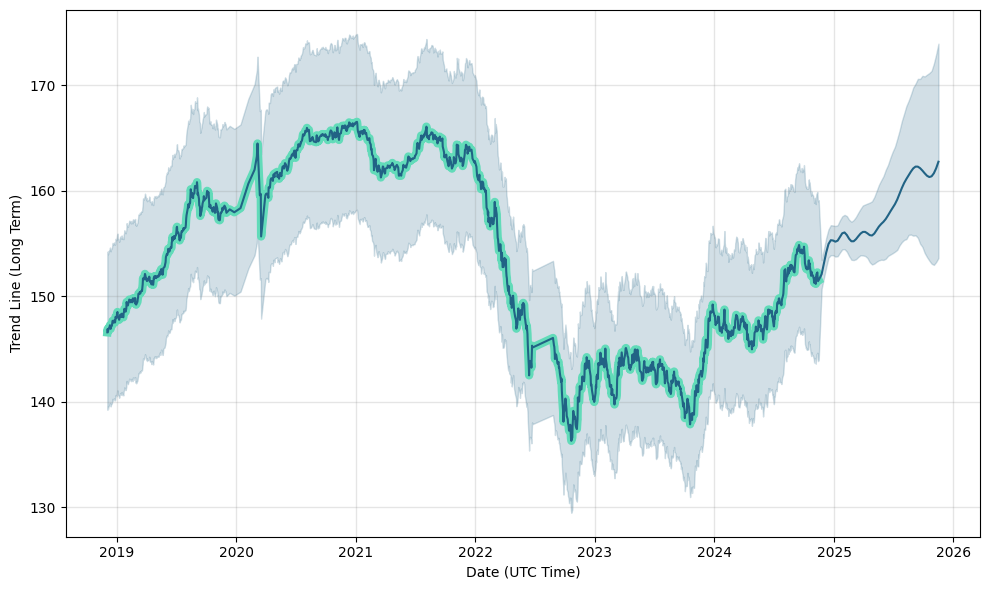

Key events shows relevant news articles on days with large price movements. VAF 0. VGB 0.

Eden its an endless world

A measure of the degree to which a portfolio's return varies from its previous returns or from the average of all similar portfolios. If the Vanguard ETF had incurred all expenses, investment returns would have been reduced. Weighted equity exposures exclude any temporary cash investments and equity index futures. Risk indicator. In particular, the content does not constitute any form of advice, recommendation, representation, endorsement or arrangement by FT and is not intended to be relied upon by users in making or refraining from making any specific investment or other decisions. Add to Your Watchlists New watchlist. Benchmark undefined. Skip to Content. All other figures represent average annual returns. Past performance of a security may or may not be sustained in future and is no indication of future performance. All other figures represent average annual returns. The management expense ratio MER is the MER as of December 31, , including waivers and absorptions and is expressed as an annualized percentage of the daily average net asset value. YTM Yield to Maturity effective is the rate of return an investor would receive if the fixed income securities held by a fund were held to their maturity dates.

International mutual funds add diversification to a U. Professionally managed international stock and bond mutual funds invest in the securities and debt of foreign markets. You can use just a few funds to invest overseas.

Diversification Asset type. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Note 2: Management expense ratio MER The management expense ratio MER is the MER as of December 31, , including waivers and absorptions and is expressed as an annualized percentage of the daily average net asset value. All other figures represent average annual returns. Total Assets. All investment funds, including those that seek to track an index are subject to risk, including the possible loss of principal. While the Vanguard ETFs are designed to be as diversified as the original indices they seek to track and can provide greater diversification than an individual investor may achieve independently, any given ETF may not be a diversified investment. Performance figures include the reinvestment of all dividends and any capital gains distributions. Ad blocker detected. Risk Indicator. Vanguard Investments Canada Inc. Prices and Distributions. Figures for periods of less than one year are cumulative returns. Average maturity.

Now all is clear, I thank for the help in this question.

I congratulate, you were visited with simply magnificent idea

Now all became clear, many thanks for an explanation.