Virgin money m plus saver interest rate

No monthly fee for maintaining the account.

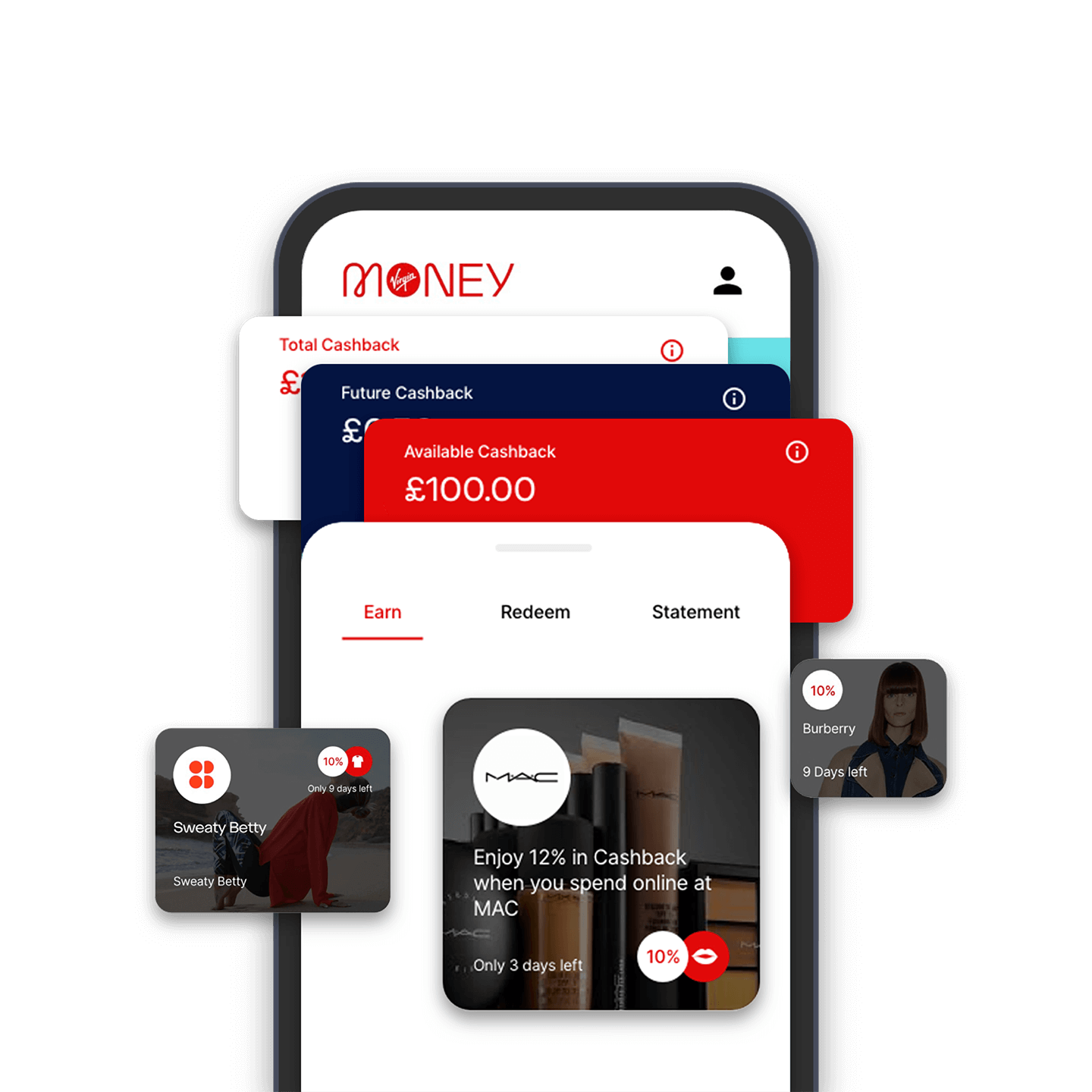

Virgin Money is helping savers make the most of their money by raising the interest rate on some of its popular savings accounts for the second month in a row — the current account linked saver and the Easy Access Cash ISA Exclusive. As of Thursday 20th July, the current account linked savings rate increased from 3. Virgin Money current accounts — the M Plus Account Link opens in a new window , Club M Account Link opens in a new window Account and basic bank account M Account Link opens in a new window — all automatically come with a linked savings account, making it easy for customers to manage their money and transfer savings to and from their current account. Customers can manage their Easy Access Cash ISA Exclusive account online, where they can also top up and take money out whenever they like. The increases in rates for both the current account linked saver and Easy Access Cash ISA Exclusive will be automatically passed onto all existing customers who have the accounts. On the fourth withdrawal, the interest rate will reduce to 2.

Virgin money m plus saver interest rate

AER 1 3. Interest paid quarterly. All rates are variable. Introducing the M Plus Saver - our most flexible way to save. Start saving with as little as you like, and earn 3. A free and easy-to-use M Plus Account. Our most popular current account comes with an interest rate that hits the high notes. Earn 2. Interest is calculated on a daily basis and paid on the last working day of each calendar quarter. We may increase your rate without giving you notice.

Linked to the M Plus Saver 3.

The M Plus Account pays interest at 2. Interest is calculated on a daily basis 3 and is paid on the last business day of each month. The M Plus Saver pays interest based on the money in your account. Interest is calculated on a daily basis and is paid on the last business day of each quarter. Find out more about fees and charges. And remember, you earn interest on the whole M Plus Saver!

AER 1 3. Interest paid quarterly. All rates are variable. Introducing the M Plus Saver - our most flexible way to save. Start saving with as little as you like, and earn 3. A free and easy-to-use M Plus Account. Our most popular current account comes with an interest rate that hits the high notes. Earn 2.

Virgin money m plus saver interest rate

The amount of the Refusing A Payment Due To Lack Of Funds Fee and debit interest will be notified to you at the end of each calendar month, giving you at least 14 days notice before it is applied to your account. When we're talking about our current accounts, we have to use certain words and phrases to describe key things like your Arranged Overdraft. You can find them in our Glossary of Terms. We'll work out the interest you need to pay using the amount you're borrowing at the end of each day.

Mortgage calculator new orleans

Service to make you smile We want all our customers to feel happier about money. All rates are variable. Monthly interest is paid on the 10th day of each month, and will be available the next working day. This is a borrowing limit on your account that we agree with you in advance, so it's there when you need it. Our new Virgin Money mobile app is available now. Why are you making this change? The example assumes that: no further deposits or withdrawals are made; any interest earned stays in the account; and there is no change to the interest rate. Discover Business Internet Banking See money in a whole new light with smart digital tools at your finger tips. Monthly interest is paid on the last day of the month, and will be available the next working day. Continue application. However, if you are creating a new standing order you will need to authenticate the payment. How do I download my online statements? Investor relations Investor relations Results and reporting Company announcements Shareholder information Share price Debt Investors Consensus estimates. Frequently asked questions Can you change my interest rates? You're ready to apply if: You're 18 or over and live in the UK over 16s can open an account in Store.

No monthly fee for maintaining the account. You'll need to be over 18 and a UK resident to apply online. Check out all the terms, tariff and other important information.

Why am I being asked to provide my postcode with my One Time Passcode, when shopping online? If you earn interest over your Personal Savings Allowance you will be required to pay any tax due yourself directly to HM Revenue and Customs. Take money out At any time. New to investing? Read a quick recap, then apply. Credit interest is calculated daily on the cleared credit balance in your account. Very quick, easy and simple to apply for this current account and also the associated savings account. It gives you access to tailored deals on financial products and services — which are based on your account information. Master your spending. The M Plus Saver pays interest based on the money in your account. New application?

I apologise, but, in my opinion, you commit an error. I suggest it to discuss.

Absolutely with you it agree. I like your idea. I suggest to take out for the general discussion.

The important answer :)