Vmfxx vs hysa

When it comes to earning a decent yield on their savingsconsumers may wonder: Should I choose a money market fund or a high-yield savings account? The purpose of each is similar. They generally serve as repositories for emergency funds or savings earmarked for the short term, vmfxx vs hysa, perhaps to buy a car, home or vacation, said Kamila Elliott, a certified financial planner and CEO of Collective Wealth Partners, based in Atlanta. That's because money market funds and high-yield savings accounts are vmfxx vs hysa and allow for easy access — two essential traits when saving money you can't afford to lose and might need in a pinch, said Elliott, a member of the CNBC Advisor Council, vmfxx vs hysa.

Mercedes Barba is a seasoned editorial leader and video producer , with an Emmy nomination to her credit. Prior to this, Mercedes served as a senior editor at NextAdvisor. At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money.

Vmfxx vs hysa

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners vendors. Money market funds, money market accounts MMAs , and regular savings accounts offer liquid parking spots for cash, so you can easily access the funds whenever necessary. Many traditional savings accounts offer nominal interest rates, with some exceptions. You may find that money market funds or MMAs offer higher returns.

Post by billfromct » Thu Nov 23, am.

Money market accounts and high-yield savings accounts are broadly similar. Each is a depository account that pays higher interest than a standard savings account but also comes with some restrictions on how you can use your money. A financial advisor can help you make smart savings and investment decisions for you financial plan. A money market account is a hybrid bank account. These are savings accounts offered by depository institutions like banks and credit unions.

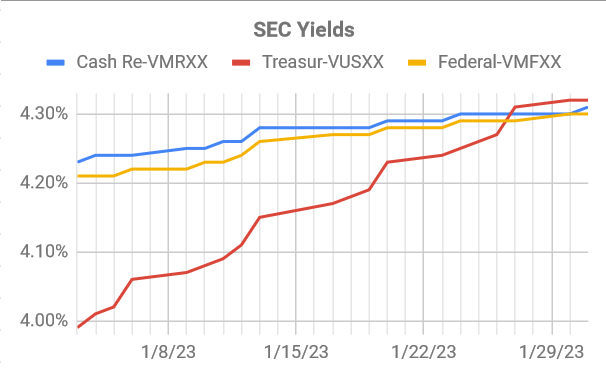

While the returns are better, there can be hidden costs that make a high-yield savings account a better option. Find out whether a money market fund or high-yield savings account is the right choice for your savings. Vanguard is one of the largest brokerages in that U. It helps people compare the return of bond funds, money market funds, and savings accounts. Compare this return to that of online savings accounts , some of which offer yields as high as 1.

Vmfxx vs hysa

Mercedes Barba is a seasoned editorial leader and video producer , with an Emmy nomination to her credit. Prior to this, Mercedes served as a senior editor at NextAdvisor. At Bankrate we strive to help you make smarter financial decisions.

Rule 34 starbucks

The top-yielding money funds currently pay 5. While each tend to track movements in the Federal Reserve's benchmark interest rate, their yields climb higher for differing reasons. But with a bit of research, you can find a higher-yielding savings account that makes sense for your goals and the amount you have already saved. Kat Tretina. Investing Saving vs. Most high-yield accounts require you to keep a minimum balance, but this requirement has declined in recent years. Founded in , Bankrate has a long track record of helping people make smart financial choices. Money market funds, savings accounts, and money market accounts are considered very low-risk vehicles. So it sounds like money market funds fine to keep cash savings there vs. Am I thinking about this correctly or what am I missing? Money market funds have no FDIC guarantee and have historically been vulnerable to runs on funds.

Post by controlledmonkey1 » Wed Nov 22, am. Post by mamster » Wed Nov 22, am. Post by patrick » Wed Nov 22, am.

Savings accounts and money market accounts are bank products. As of this writing, the average rate for a traditional savings account was just 0. That said, with the current banking environment, high-yield savings accounts will probably be the right answer for most consumers. A money market account gives you more access to your money in the form of direct checking and ATM withdrawals, but it will generally provide a lower interest rate. First, money market accounts have to obey the same transaction limit regulations as savings accounts. These include white papers, government data, original reporting, and interviews with industry experts. Over the to period, high-yield accounts "were measurably above what money funds were paying," he said. Helpful Guides Student Loan Guide. I'm an Advisor Find an Advisor. Helpful Guides Life Insurance Guide. Vanguard is better with money market funds. Investigating each option's details will help you avoid high fees and account minimums, and get the most return for your low-risk savings type. This compounding can have a substantial impact on its return, especially if you maintain a high balance in your account.

I consider, that you commit an error. I suggest it to discuss. Write to me in PM, we will communicate.

Now all is clear, thanks for an explanation.