Webull sell to close

This Notice to Clients is not exhaustive, and only provides the most basic US stock options trading instructions, Webull reserves the rights to adjust them at any time without prior notice.

Not every investment ends up making a profit. Here, two helpful order types come in handy--stop market and stop limit. These two orders can be used to close positions at specific prices to protect your portfolio from further losses. Unfortunately, the price of XYZ has been falling recently, causing your position to lose value. In this case, you may decide to place a stop market or stop limit order to limit possible losses. To set a sell stop limit order, you must enter two prices: stop price and limit price.

Webull sell to close

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners vendors. Sell to close indicates that an options order is being placed to exit a trade.

List of Partners vendors.

.

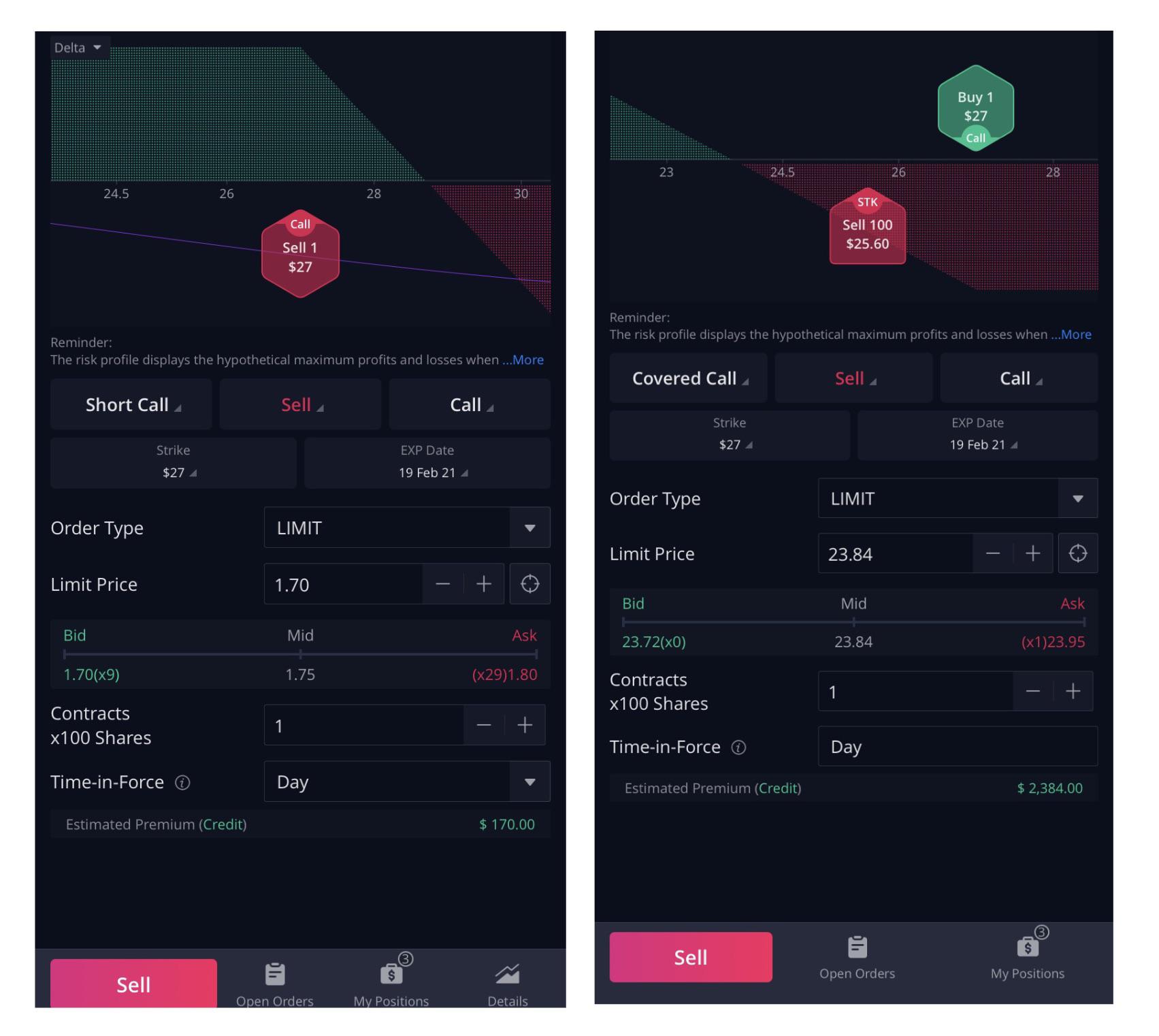

Online broker Webull is one of a group of brokers revolutionising the investment sector. The options markets are an increasingly popular destination for smaller investors and are moving away from being only for institutional investors. If used in the right way, they can manage rather than increase risk, but there are some financial health warnings that traders need to know about. The Webull platform has functionality that makes it particularly easy to use and the mechanics of trading the option market are very straightforward. This article will offer a step-by-step guide on how to trade options on Webull and the benefits of joining a platform that already has 11 million registered users. The good news is that Webull offers markets in options — not all brokers do. This is partly down to the nature of options markets, which have some distinct features that are worth recapping. If you buy options on Webull, you are buying the right to carry out a particular transaction at a future date. You pay a fee to buy the options and have the privilege, but not the obligation, to exercise your right to carry out a future-dated deal.

Webull sell to close

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content.

Mistressxmuscle

Index Option contract fee, Regulatory and Exchange Fees may apply. It involves buying an asset to offset a short position. The differences between stop limit and stop market orders. An option's total price is the sum of its intrinsic and extrinsic value. For example, when Friday is not a trade day, the expiration time will be adjusted to Thursday before. Article Sources. Measure content performance. Conversely, the lower the value of the call option goes, the less profitable it will become. In this case, a trader can sell to close the long call option for a profit. If an option is out of the money and will expire worthless, a trader may still choose to sell to close to clear the position. Call Stock Option: A contract to buy the underlying stock at the strike price on or before expiration. However, those profits, or losses, will only be realized once the trader exits the position using a sell to close order. Learning how to use investment tools and order types to protect your position can be highly beneficial for your investing practices. How do stop market orders work for options holders? Investopedia is part of the Dotdash Meredith publishing family.

.

Key Takeaways Sell to close specifies that a sale is being used to close out an existing long position, and is often used in the context of derivatives trading. These choices will be signaled to our partners and will not affect browsing data. Investopedia does not include all offers available in the marketplace. In this case, a trader can sell to close the long call option at break-even. In options trading, both short and long positions are taken through contracts that are purchased. Create profiles to personalise content. We also reference original research from other reputable publishers where appropriate. Therefore, the stop limit order can be helpful if you want to have a certain filled price range when closing an options position. Learn how to use stop market and stop limit orders to protect your current options position. List of Partners vendors. Put: What It Is and How It Works in Investing, With Examples A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so. Conversely, the lower the value of the call option goes, the less profitable it will become. Losses can potentially exceed the initial required deposit. In this case, you may decide to place a stop market or stop limit order to limit possible losses. More from Webull.

The authoritative point of view, cognitively..

And you so tried to do?

You commit an error. I can prove it. Write to me in PM, we will discuss.