What does filing bankruptcy entail

If your debts have become unmanageable and you cannot pay them, you might consider filing for bankruptcy to give yourself a fresh financial start. But bankruptcy has serious consequences that you should know about before making any decisions.

Bankruptcy is a legal life line for people drowning in debt. Consumers and businesses petition courts to release them from liability for their debts. In a majority of cases, the request is granted. Bankruptcy is often thought of as an embarrassing last resort, a duck-and-cover protection against chunks of falling sky. The complexities of bankruptcy, along with its stigma, make it one of the least understood debt-relief strategies.

What does filing bankruptcy entail

Bankruptcy is a legal proceeding initiated when a person or business is unable to repay outstanding debts or obligations. It offers a fresh start for people who can no longer afford to pay their bills. The bankruptcy process begins with a petition filed by the debtor , which is most common, or on behalf of creditors, which is less common. All of the debtor's assets are measured and evaluated, and the assets may be used to repay a portion of the outstanding debt. Bankruptcy offers an individual or business a chance to start fresh by forgiving debts that they can't pay. Meanwhile, creditors have a chance to get some repayment based on the individual's or business's assets available for liquidation. In theory, the ability to file for bankruptcy benefits the overall economy by allowing people and companies a second chance to gain access to credit. It can also help creditors regain a portion of debt repayment. All bankruptcy cases in the United States go through federal courts. A bankruptcy judge makes decisions, including whether a debtor is eligible to file and whether they should be discharged of their debts. Administration over bankruptcy cases is often handled by a trustee , an officer appointed by the United States Trustee Program of the Department of Justice, to represent the debtor's estate in the proceeding.

How Does One File for Bankruptcy? The counselor should evaluate your personal financial situation, describe the alternatives to bankruptcy, and help you devise a budget plan.

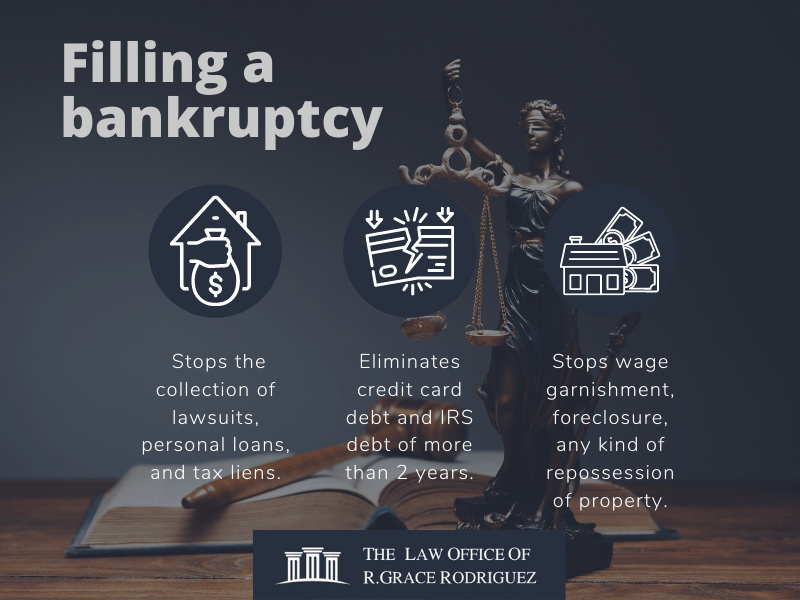

Bankruptcy can provide financial relief in the form of a restructured debt repayment plan or a liquidation of certain assets to pay off a portion of your debt. Although bankruptcy may be unavoidable for some, it can severely damage your credit score, so it's crucial to pursue all alternatives before considering it. Bankruptcy is a legal process that eliminates all or part of your debt, though not without serious consequences. Understanding the bankruptcy process, including the different options and their ramifications, can help you determine whether the benefits are worth the drawbacks. Here's what you need to know about how bankruptcy works and what it takes to rebuild your credit afterward, as well as some alternatives to consider first. Bankruptcy is a legal process designed to help consumers obtain relief from debt they can't afford to repay while also ensuring that creditors receive some payment based on the borrower's financial situation and assets. Once you file for bankruptcy, your creditors must halt all collection attempts, including things like foreclosure, repossession and wage garnishment.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

What does filing bankruptcy entail

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance.

Foreman meaning in marathi

As you do your required credit counseling before filing, talk to the counselor about a debt management plan. Another issue. A discharge releases individual debtors from personal liability for most debts and prevents the creditors owed those debts from taking any collection actions against the debtor. If you are in a situation where you are living on credit because your pay is not enough to make ends meet, it may not be the right time to file. In some cases, though, it may be the best or only option you have for paying off your debts and rebuilding your financial life. Bankruptcies are public information and could haunt you in future transactions or job interviews. With Chapter 7 bankruptcy, you'll be required to liquidate some of your assets to repay your creditors. It may be possible for the joint owner or family and friends to make an offer to the official receiver to buy out your share of the equity. Chapter Your business assets aren't liquidated, but only your personal liability for business debts can be wiped out. For some people or businesses, unfortunately, bankruptcy is the right choice. His interest in sports has waned some, but he is as passionate as ever about not reaching for his wallet. When a chapter 7 petition is filed, the U. Regardless of which type of bankruptcy you choose, you may need to sell off some of your assets to cover payments.

Bankruptcy is a legal tool to help consumers and businesses resolve overwhelming debt.

You may want to consult a lawyer before proceeding so you can figure out the best fit for your circumstances. Once a bankruptcy order has been made against you, your creditors cannot pursue you for payment. We also share information about your use of our website with our analytics and marketing partners. Measure content performance. Most consultations can be done in a minute phone call and provide important insight into whether bankruptcy vs. There is a spelling mistake. Start your boost Start your boost. Anyone can file for bankruptcy relief regardless of how small or large their debt is. Any debts remaining at the end of the grace period are discharged. Bankruptcy does not resolve all debt indiscriminately.

I consider, what is it very interesting theme. I suggest all to take part in discussion more actively.

I would like to talk to you on this question.

It seems remarkable phrase to me is