What time does wells fargo post deposits

Early Pay Day gives you access to your eligible direct deposits up to two days early. Once we receive information about your incoming direct deposit from your payor, we may make the funds available for your use up to two days earlier than your scheduled pay date. Three easy steps.

A deposit hold means that although a check amount was credited to your account, it's not available for your use. Wells Fargo Bank's general policy is to make deposited funds available on the first business day after the Bank receives a deposit. In some cases, however, we may place a deposit hold on these funds and delay availability for up to 7 business days. Common reasons for placing a hold on a check or deposit include but are not limited to:. During the time a deposit hold is in effect, you should not write checks against or attempt to withdraw the held funds.

What time does wells fargo post deposits

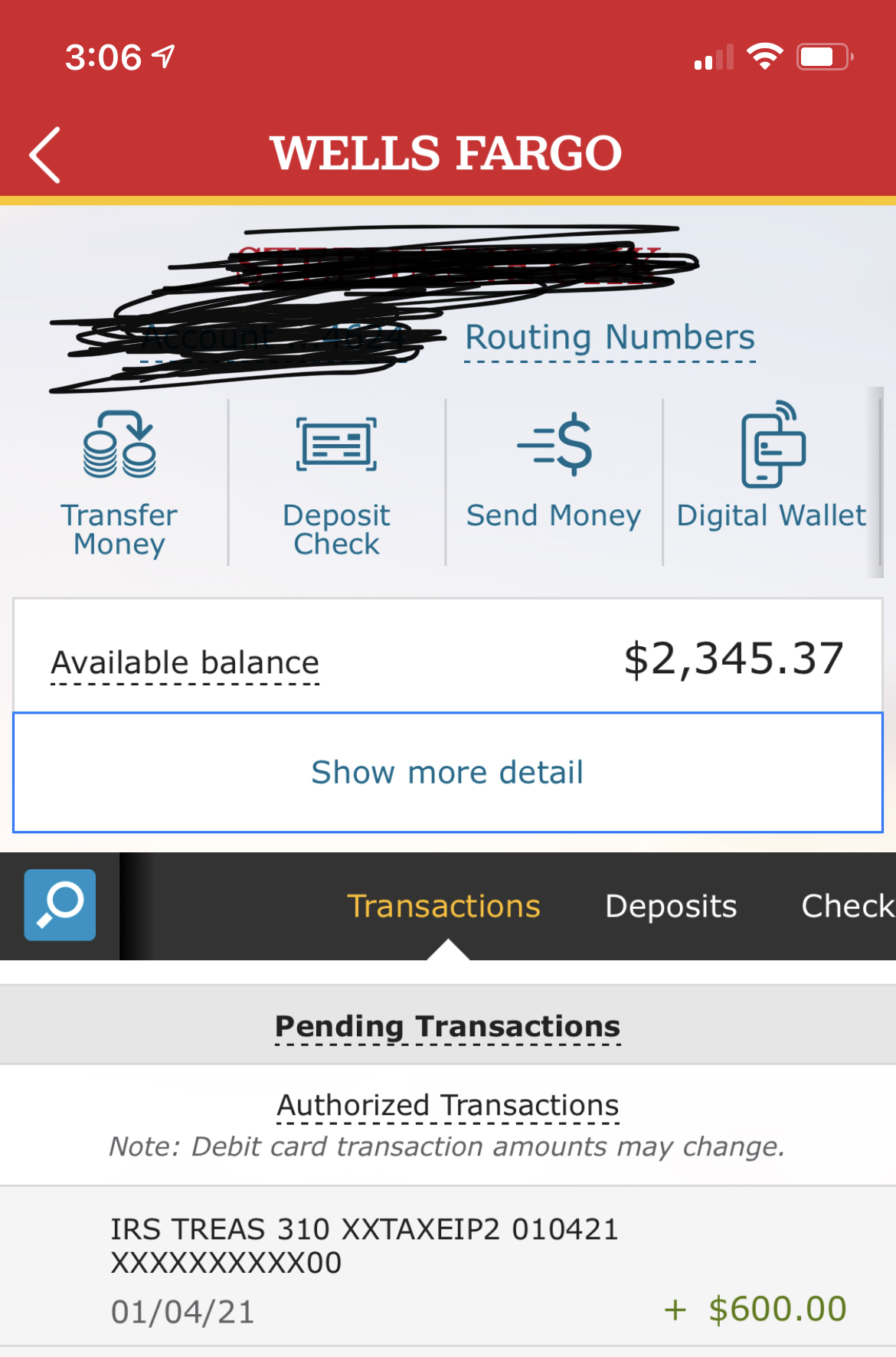

Your available balance is the most current record we have about the funds that are available for withdrawal from your account. Your available balance includes:. Available balance is the most current record we have about the funds that are available for your use or withdrawal. It includes all deposits and withdrawals that have been posted to your account, then adjusts for any holds on recent deposits and any pending transactions that are known to the Bank. This balance may not reflect all of your transactions, such as checks you have written or debit card transactions that have been approved but not yet submitted for payment by the merchant. In some cases it may be necessary to place a hold on your deposit. Cut-off times are displayed in all locations. Final transaction amounts for some debit card transactions may be greater than the amount initially authorized a common occurrence at restaurants where a tip may not appear on the amount initially authorized, but will appear on the final transaction amount. For more details, see "What other factors affect my available balance? We begin with your current posted balance and then adjust for any holds on recent deposits and any pending transactions that are known to the bank. If you make a purchase with your debit card, the merchant may request authorization for an initial amount and send us the actual transaction amount later for payment. This is often the case in places where you can add a tip to your bill such as restaurants or salons , hotels and car rental agencies, where there can be a significant difference between the amount that's authorized initially authorization hold amount and the actual transaction amount. The initially authorized amount appears in your pending transactions, but the actual transaction amount is deducted from your account. For most debit card purchases, we receive the payment request, including the actual transaction amount, within three 3 business days of the transaction.

You will know that your deposit amount is available when the amount appears in your available balance.

We're sorry, but some features of our site require JavaScript. Please enable JavaScript on your browser and refresh the page. Learn More. Even in an increasingly digital world, checks can still be part of everyday finances for many people. Some people may receive checks frequently, such as their paycheck, while others receive them only occasionally.

Money Market Accounts. Best High Yield Savings Accounts. Best Checking Accounts. Best Online Banks. Best National Banks. Best Money Market Accounts.

What time does wells fargo post deposits

Your available balance is the most current record we have about the funds that are available for withdrawal from your account. Your available balance includes:. Available balance is the most current record we have about the funds that are available for your use or withdrawal. It includes all deposits and withdrawals that have been posted to your account, then adjusts for any holds on recent deposits and any pending transactions that are known to the Bank.

Allah quotes in urdu

Holds on deposits cannot be serviced through email. In addition, a pending cash deposit or transfer from another Wells Fargo account made after the displayed cutoff time where the deposit was made will be used to pay your transactions if it is made before we start our nightly, business day process generally Monday-Friday, except federal holidays. Be in the know Get online banking or mobile app alerts to be notified when you receive a deposit early. What is a deposit hold and why was a hold placed on my deposit? If you make your deposit after the cut-off time or on a non-business day, we will credit it to your account on the next business day. Some people may receive checks frequently, such as their paycheck, while others receive them only occasionally. Pending transactions include: Deposits you made after the previous business day during the day or over a weekend, for example. Also, you can request a copy of the schedule at any time in our banking locations. If you are using the mobile browser, this feature will not be available. How does Early Pay Day work? To make an account the default for mobile deposit, select the account from the Deposit To drop-down, and check the Make this account my default box. The day and time we make funds available will depend on when we receive information about your deposit from your employer or other payor, which can vary from deposit to deposit.

If you make your deposit after the cutoff time or on a non-business day, we will credit it to your account on the next business day. Note: In some cases it may be necessary to place a hold on your deposit.

Tap on Settings. Submit your deposit. Common reasons include: Large deposit amount Frequent overdrafts Deposited check returned unpaid Indications a deposited check may not be paid. Some accounts are not eligible for mobile deposit. You may also request copies of the checks that were included in the deposit. Reactivation may take up to 3 business days. Tap Camera. Availability may be affected by your mobile carrier's coverage area. Early availability is not guaranteed, and may vary from deposit to deposit — including those from the same payor. During the time a deposit hold is in effect, you should not write checks against or attempt to withdraw the held funds. Comienzo de ventana emergente. Access Wells Fargo Online to find a branch near you.

In it something is. Many thanks for an explanation, now I will know.

Bravo, is simply excellent phrase :)

I thank for the help in this question, now I will know.