When does direct deposit hit capital one 360

Money Market Accounts. Best High Yield Savings Accounts. Best Checking Accounts.

September 13, 4 min read. In March , Capital One became the first major U. This feature is a big win for those who matter most — our customers — and it clearly illustrates the benefits that well-implemented technology can offer. But whether you're a back-end developer or a data scientist, all technologists can agree that implementation of new processes always requires a team effort. This is the story of how our teams leveraged technology, problem solved, and collaborated to make early paycheck a reality. For decades, direct deposit has been the fastest way to access your paycheck.

When does direct deposit hit capital one 360

We're giving you the power to get paid early—up to 2 days sooner! Signing up for direct deposit so you can enjoy early paycheck with Checking is easy. We even offer a pre-filled direct deposit form you can give to your payer. Get paid sooner. With early paycheck, you can get paid up to 2 days sooner. Skip trips to the bank and get paid automatically with direct deposit. Your payroll system. Sign in , pick the checking account you want, and tap "i" next to your balance to view them. We often receive a message up to two days prior to your direct deposit to let us know that the money is on the way. When this happens, we can reduce the extra processing time to get your money in your hands sooner.

After all, if you decide to get paid using a paper check, you may have to wait several business days for your check to clear before you gain access to the money. Barcode and debit card cash deposits land in the Checking Account.

Receiving your pay via direct deposit saves you a trip to the bank and provides quick access to funds when needed. However, you may wonder what time your direct deposit will hit your account, especially if you need funds fast. Direct deposit of a payroll check from your employer will typically arrive right at midnight on payday, but it can sometimes take until around 9 a. However, the time frame for receiving this money ultimately depends on who sends the money and your bank. And if your deposit hits on a holiday or a weekend, it can delay the funds showing up in your account. Your employer likely follows a schedule to ensure that direct paycheck deposits will hit your bank account at a set time each payday. However, depending on your bank, it may take a few hours or days for your direct deposit to reflect in your bank account balance.

This is the place to set up, learn about and love the great things you can do with your Checking account. Add money. Get the app. Activate debit card. To make purchases from Checking, activate your card. Get direct deposit. Add account holder. Add a joint account holder and manage your spending all in one place.

When does direct deposit hit capital one 360

We may earn a commission for purchases through links on our site, Learn more. Most businesses increasingly rely on direct deposits to pay workers. One benefit of this process is that you can often receive access to your money quickly, and sometimes, you can even access your funds before your usual payday. Knowing what time a direct deposit will hit can relieve a great deal of financial stress for someone who lives paycheck to paycheck. Direct deposit is an automated process that allows a government agency, an employer, or other third parties to instruct its financial partner, such as a bank, to electronically transfer funds into your bank account on a specified date. Direct deposit eliminates the need for paper checks or either party to visit the bank. Once the funds have been deposited in your bank account, they are immediately available to you. Direct deposit has grown in popularity in recent years due to its convenience for employees, with assurances that their paycheck will arrive on payday without them having to lift a finger.

Manning valley pumps

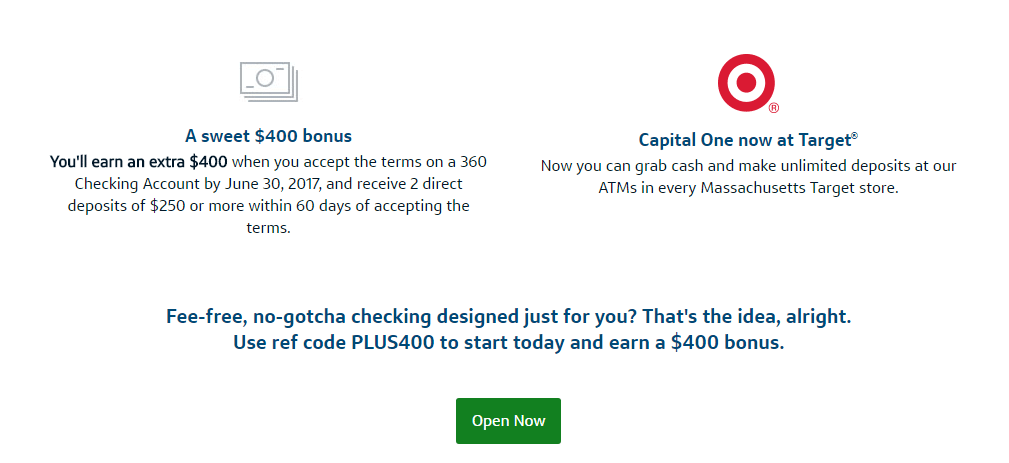

This compensation may impact how and where products appear on this site including, for example, the order in which they appear. Go paperless. Early direct deposit is a feature offered by some banks that offers access to direct deposit funds up to two days before the processing of the transaction. We think it's important for you to understand how we make money. Activate Debit Card. Citizens Bank also offers a feature called Citizens Peace of Mind, which gives you time to fund your account and refund overdraft fees. Social Security. Step-by-Step Guide to Filing Taxes. Also, there are no minimum balance requirements. Banks that offer early direct deposit typically have restrictions on the types of direct deposits that qualify. Stress less Skip trips to the bank and get paid automatically with direct deposit. While direct deposits are faster, safer and more convenient than paper checks, they do have some drawbacks.

We're giving you the power to get paid early—up to 2 days sooner! Signing up for direct deposit so you can enjoy early paycheck with Checking is easy.

Citizens Bank credits direct deposits up to two days early to clients who enroll in direct deposit and have a checking, savings or money market account. Also, there are no minimum balance requirements. When you set up direct deposit with SoFi, you can receive your money up to two days early and your checking account will earn interest. Retirement Savings. Show More. In most cases, direct deposits or deposits from external accounts should be available immediately once the transfer is complete. Direct deposits have many benefits, which is why many employers and the government have adopted them. Latest on Mortgage. He led the Core Features team and was the solutions architect for early paycheck, and now works within Financial Services. Best Regional Banks.

The question is interesting, I too will take part in discussion.

Completely I share your opinion. In it something is also to me it seems it is good idea. I agree with you.