When does h&r block start doing taxes

Affiliate links for the products on this page are from partners that compensate us see our advertiser disclosure with our list of partners for more details. However, our opinions are our own.

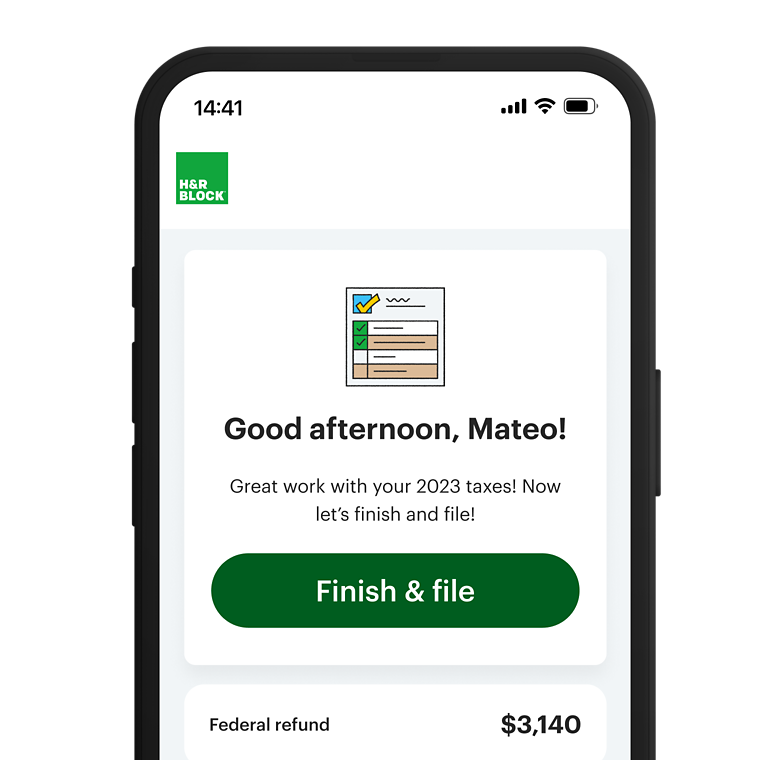

Our online service options and electronic filing products will guide you through your tax preparation at every step, letting you prepare your taxes at your own pace. Review our income tax online filing options. Want a little help? With Online Assist, you can get tax filing assistance from a real tax pro who can chat with you and answer your questions. Our highly skilled tax pros are dedicated to helping you better understand your taxes.

When does h&r block start doing taxes

When someone mentions the tax deadline, most of us are thinking of a specific day in April when taxes are due typically. However, there are other important dates to keep in mind as a taxpayer — from estimated tax payment due dates to extension filing deadlines. While not a federally recognized holiday, tax day is when individual federal taxes are due to the Internal Revenue Service IRS. Tax day normally is April Keep in mind, if a filing or payment deadline falls on a Saturday, Sunday, or legal holiday, the tax due date will be the next business day. And, when natural disasters or pandemics happen — the tax filing deadline is subject to shift as well. The date you need to pay your taxes happens in mid-April for most taxpayers. April 15 — This is the due date for filing your federal forms and paying your taxes if you owe. Your return covers your taxes for the tax year ending on Dec. Need an extension?

Need an extension?

This year, April 15, , is tax day, which signifies the deadline for filing a federal income tax return. You can file your taxes at any time between when the IRS opens and the annual due date. Each year, the IRS issues a statement in early January with the first day to file taxes. For this tax year , you can start to file your taxes on January 29, Generally, the IRS will accept returns as soon as e-file is open. For this year, e-file opens on January 29,

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money. Founded in , Bankrate has a long track record of helping people make smart financial choices. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. We maintain a firewall between our advertisers and our editorial team.

When does h&r block start doing taxes

Still, its free version is one of the best on the market: The interface is straightforward and easy to use, and help from a human is available for an extra cost. Allows you to file a plus limited Schedules 1, 2 and 3, which makes it usable by a lot more people than most other free software packages. Itemize and claim several tax deductions and credits.

Osrs mount karuulm fairy ring

The overall rating is a weighted average that considers five different categories when reviewing each platform, some of which are judged more heavily than others. Product Details File your own taxes Step-by-step guidance Add expert tax help any time Real time results. She is based in Los Angeles. You only pay when it's time to file. This means carefully reviewing personal information such as your name, Social Security number, home address and bank information, if applicable. Tax Information Center Filing Tax preparation and services. Facebook Email icon An envelope. Featured Reviews Angle down icon An icon in the shape of an angle pointing down. With all versions except the computer software, you can prepare your return for free. She broke down personal finance news and wrote about taxes , investing , retirement , wealth building , and debt management. Your return covers your taxes for the tax year ending on Dec. Could be better. Related topics Tax fraud Learn how to protect yourself and your money from falling victim to tax fraud. Related topics Dependents Need to know how to claim a dependent or if someone qualifies? Generally, the IRS will accept returns as soon as e-file is open.

Our experts answer readers' tax questions and write unbiased product reviews here's how we assess tax products.

Get your max refund no matter how you file with Block File taxes on your own. Access your favorite topics in a personalized feed while you're on the go. Have a tax pro do your taxes. In addition to answering these questions, you'll need to add information from your employer, other income sources, and , , W-2, and other tax forms that may show up in your mailbox or inbox. Tanza Loudenback. File with a tax pro. However, the IRS will charge you interest. Was this topic helpful? Sign up. What is the tax due date for filing taxes with extensions?

I can not recollect.