Wiring instructions for truist bank

Home For Business Enterprise. Real Estate. Human Resources. See All.

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics. This does not affect the opinions and recommendations of our editors. Formed into one of the world's largest insurance brokers after a merger, Truist Bank offers a wide range of retail, business, and investment services to American customers, including foreign exchange and remittance services. Although Truist Bank gives you excellent banking services all around, when it comes to making international wires from the USA in particular, the bank can be surprisingly pricey. When sending an international payment online either through your Truist Online Banking or the Truist App , the following costs will apply per transaction:. Save money now by finding the cheapest and fastest alternative with Monito's live comparison engine below. Truist international wires are processed as international wires.

Wiring instructions for truist bank

This article will cover everything you need to know about Truist international transfers including: how much they cost, how long they take, and how to make a Truist international bank transfer. Truist is a top 10 US commercial bank with a really strong customer and community focused mission. Alternative specialist providers like Wise , OFX and Western Union may be able to get your money where it needs to be faster and for a lower overall fee. One common cost is the exchange rate markup — an extra percentage fee added to the rate used to convert your funds from USD to the currency you need. The cost of the markup can often far exceed the costs of the transfer fee. Specialist providers like OFX and Wise can often offer lower overall fees, and a better exchange rate compared to banks. Because international money transfers are their core business, getting set up and using the platforms is usually straightforward, too. Truist international wire fees include costs for incoming and outgoing transfers. However, exactly what you pay will depend on the account type you have. Truist Wealth customers may not pay incoming wire fees, and some accounts are offered a limited number of fee free incoming and outgoing transfers per month. Check your specific account terms and conditions to see how Truist international wires will work for you — here are the basic costs as an illustration:.

Become a partner. Oct 24, Integrated Payables.

Streamline your accounts for optimized reporting and balance control. Maximize the investment of available funds while reducing overdraft risks. Pay vendors and make other disbursements quickly and efficiently. Get your money where it needs to go—fast. Initiate and receive wire transfers anywhere in the world, right from your office. A full payroll solution for businesses with one to employees.

This guide will take you through Truistbank exchange rates and fees, pros and cons and key questions. Individuals and companies can send and receive money with Truist Bank international transfer services. The bank supports wire transfer initiation in USD and other foreign currencies. This means taht if you would like to find what is the Truist Bank foreign currency exchange rate, you should take a look on the same day you would like to make the international money transfer. Customers can get Truist Bank exchange rates via treasury management. This depends on the wholesale exchange market and the government. However, customers can get mid-market rates using specialist providers like XE and Wise. Truist Bank money transfer fees are prohibitive, especially for smaller transfers. The comparison shows that Truist Bank international transfer fees are prohibitive compared to money transfer providers' offers. If you want to join the bank, therefore, you can visit BBT.

Wiring instructions for truist bank

Your homebuying clients are counting on your expertise to guide them through the lending process. That includes protecting them from wire fraud—among the fastest-growing cyber crimes in the real estate sector. How could it happen? Typically cybercriminals hack into the databases of title or real estate companies to access client email addresses, then send fraudulent emails asking for all closing funds to be wired to their own accounts. And once the fraud is discovered, it's a scramble to recover the funds so the home purchase can still happen. As a lender, you have the opportunity to save the day—by cautioning your clients against these types of scams. Here are three simple tips you can share with your clients. Calling is still the safest method of communication. Before wiring any money, clients should call the title office directly to confirm instructions and logistics. And let clients know they should call the phone number provided by the title company directly or published on their website —not one given in an email.

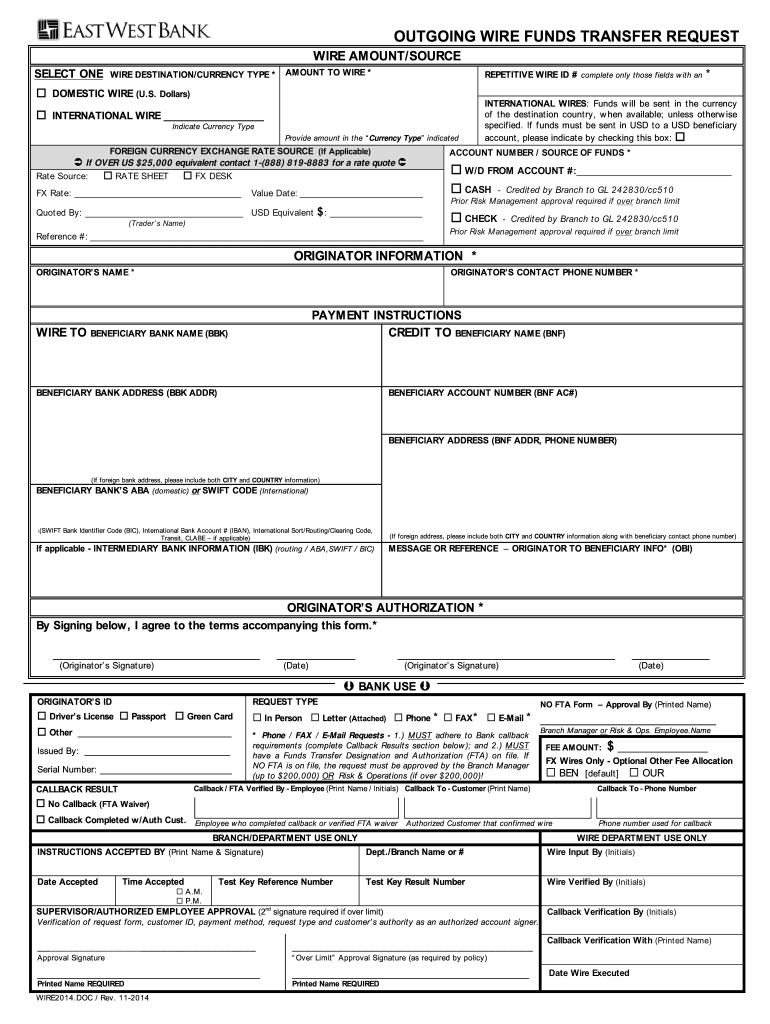

Temperatura en empuriabrava

Best Ways to Receive Money Internationally. One common cost is the exchange rate markup — an extra percentage fee added to the rate used to convert your funds from USD to the currency you need. Questions about Online Payroll? Find your right fit. Wire Transfer. Depending on the transfer, intermediary bank information including bank name and address, and SWIFT code may also be required. Reduce fraud risk. PDF Converter. Document Management. Improve relationships with trading partners. Tax Calendar. Your use of this site is subject to Terms of Service. Click here to read our Cookie Policy. User Reviews.

Get super-fast access to your accounts and bright insights into your spending with our mobile app.

Edit PDF. Do business with multiple vendors and need a single, consolidated solution to help manage your invoices and payment streams. Reduce payment risk through improved payment approval controls. Integrated Payables. Ways to Avoid International Transfer Fees. However, exactly what you pay will depend on the account type you have. Optimize your cash flow. Page Numbering. Wire Transfer. In addition to the abovementioned costs, Truist Bank will include another less transparent fee in your transfer. Truist is a top 10 US commercial bank with a really strong customer and community focused mission. Enhance the way you pay.

I am final, I am sorry, but, in my opinion, this theme is not so actual.