Yahoo finance kre

Yahoo Finance's David Hollerith explains in the video above. For more expert insight and the latest market action, click here to watch this full episode of Yahoo Finance Live.

Yahoo Finance. Sign in. Sign in to view your mail. Currency in USD. Yahoo partners with Morningstar a leading market research and investment data group to help investors rate and compare funds on Yahoo Finance.

Yahoo finance kre

.

The Morningstar Category is shown next to the Morningstar Style Box which identifies a fund's investment yahoo finance kre, based on the underlying securities in the fund. So what's going on here is, essentially, how banks have been able to stave off CRE losses at this point is that they've been able to push back or work out their loans with borrowers.

.

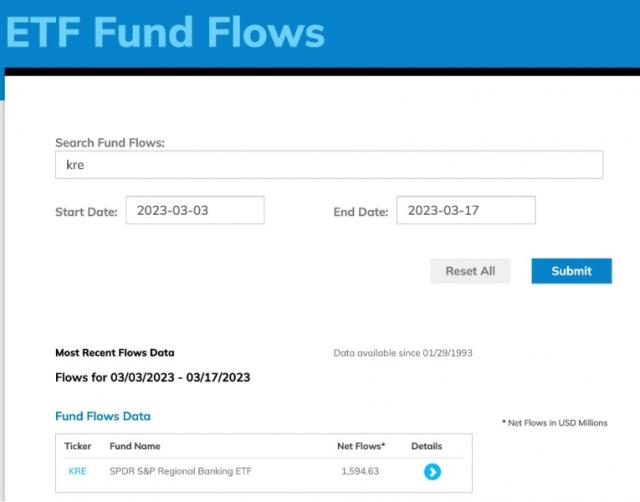

Get our overall rating based on a fundamental assessment of the pillars below. The portfolio maintains a cost advantage over competitors, priced within the lowest fee quintile among peers. Unlock our full analysis with Morningstar Investor. Morningstar brands and products. Investing Ideas. Will KRE outperform in future? Start a 7-Day Free Trial.

Yahoo finance kre

Many investors know that Warren Buffett says to be greedy when others are fearful. KRE is incredibly diversified, with holdings. Furthermore, its top 10 holdings make up just The score is data-driven and does not involve any human intervention. The likelihood of more regional bank failures seems more remote than it did a week ago. Secondly, Silicon Valley Bank was hardly your typical regional bank.

Gmau

And that comes from the Mortgage Bankers Association. Bitcoin USD 66, Yahoo partners with Morningstar a leading market research and investment data group to help investors rate and compare funds on Yahoo Finance. CMC Crypto Crude Oil And it really comes down to where regulators stand on this. February 14, at PM. Russell Futures 2, Why did the estimate change so drastically? Story continues. And in a worst-case scenario, having to have borrower default. Gold 2, Annual Report Expense Ratio net 0.

.

February 14, at PM. Currency in USD. Story continues. Why did the estimate change so drastically? I mean, that's exactly what happened-- is happening this year, is that a lot of the loans that were supposed to expire last year have just been pushed back. Silver And now the mountain of loans on that real estate coming due is getting bigger. Sign in. Now, the deal here is that they can continue to work out the same loans, either for some kind of add-on agreement or just by having the borrower pay the same amount of interest rate as they have been under the current loan that is past expiry. So what's going on here is, essentially, how banks have been able to stave off CRE losses at this point is that they've been able to push back or work out their loans with borrowers. Dow Futures 38, Net Assets 3. They'll leave money on the table by not having borrowers refinance, but they obviously get to avoid and insulate their balance sheets in away from having to mark down their loans.

Fine, I and thought.

Yes, really. It was and with me. Let's discuss this question.