10 best undervalued stocks to buy now

The biggest companies on the market spent the last 12 months getting even bigger, as both the valuations and market caps of large-cap tech stocks soared on AI hype. So far this year the 10 best undervalued stocks to buy now has been much the same — just look at the incredible rise of Meta and Nvidia in the last few weeks, and it seems like will see a repeat of large-cap dominance.

Investors have endured a lot of stock market volatility during the past few years. Given ongoing uncertainty about interest rates and the economy, investors may be wondering which stocks to buy now against this backdrop. Regardless of where interest rates and the economy are headed, investors may want to own companies that offer some sense of certainty in terms of cash flows and company fundamentals. The companies that make up this list have significant competitive advantages. We believe the best companies have predictable cash flows and are run by management teams that have a history of making smart capital allocation decisions.

10 best undervalued stocks to buy now

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. The investing information provided on this page is for educational purposes only. NerdWallet, Inc. Undervalued stocks are stocks that trade below their assumed value. Likewise, an undervalued stock trades below what it's worth. However, the companies of such undervalued stocks usually have strong balance sheets, good net free cash flow and a strong future outlook.

Detailed volatility calculation methodology is available here. The companies that make up this list have significant competitive advantages. Tata Group Stocks.

Those with the most durable advantages—known as wide-moat stocks—have outperformed the overall market. We screened for 4- and 5-star-rated stocks with moats, then identified the top performers based on their total year-to-date returns. Here are the top 10 undervalued, overperforming moat stocks. Narrow-moat companies are predicted to keep competition at bay for 10 years, while those with wide moats are expected to have a market advantage for more than 20 years. Morningstar analysts encourage investors to look at both moats and valuations to get the best long-term returns. Historical data backs this up.

The US stock market defied all pessimistic expectations this year and showed resilience in the face of a sticky inflation, geopolitical tensions and macro pressures. While the AI boom lifted stock valuations of a handful of companies to new highs, some notable analysts believe the market has a lot of room to run next year. Jackson said that earnings this year have been stronger than expected. Answering a question about his thoughts on calls from some analysts expecting the market to hit new highs next year, Jackson said that the market could indeed hit new highs in , especially if big names continue to gain value. For this article we surveyed at least 10 credible financial websites and analyst reports and picked 15 stocks that came up more frequently during our research labeled as undervalued stocks.

10 best undervalued stocks to buy now

Investors have endured a lot of stock market volatility during the past few years. Given ongoing uncertainty about interest rates and the economy, investors may be wondering which stocks to buy now against this backdrop. Regardless of where interest rates and the economy are headed, investors may want to own companies that offer some sense of certainty in terms of cash flows and company fundamentals. The companies that make up this list have significant competitive advantages. We believe the best companies have predictable cash flows and are run by management teams that have a history of making smart capital allocation decisions. How much an investor pays to own a company—best or otherwise—is important, too. The 10 most undervalued stocks from our Best Companies to Own list as of Feb.

Boxel rebound

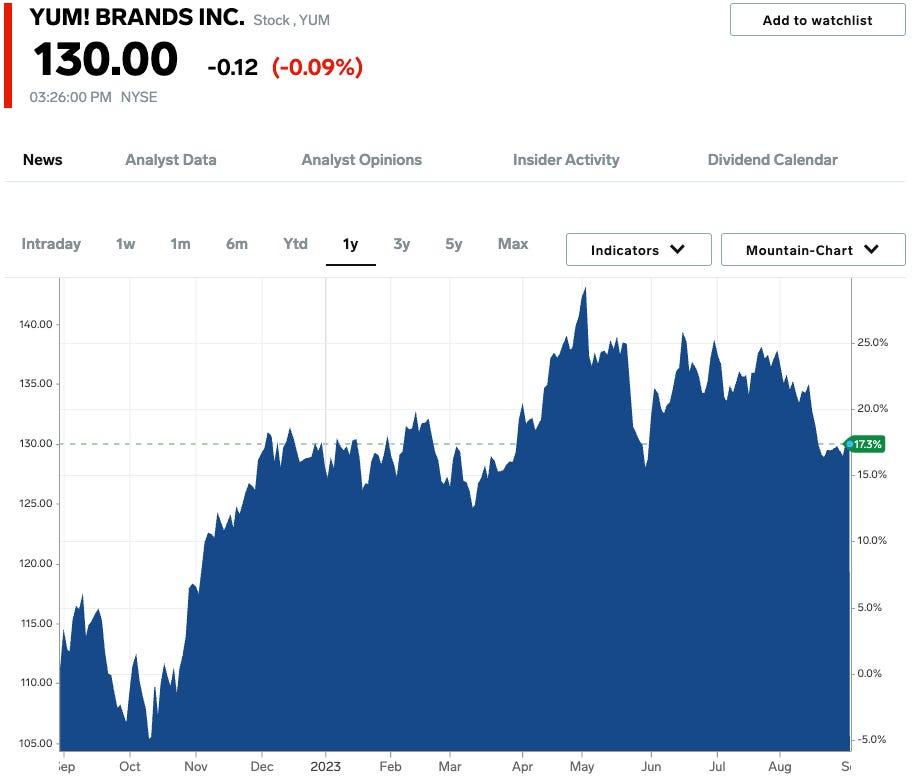

The statistics below are current as of Feb. Eicher Motors Ltd. Avenue Supermarts Ltd. Read next. Coupled with strong brand recognition and an unrivaled supply chain, Yum China is set to be the prime beneficiary of growing Chinese fast-food spending. Copy Link. But what about the ones that are still cheap — or less expensive — on a valuation basis? We have a 1 rating, accordingly. The PEG of 2. Ticker : VFC. Crop protection should see strong profit growth from a return to normal demand and the rapidly increasing demand for biologicals, where Corteva is the market leader, that farmers use to fight resistant pests. Cement Stocks. Alphabet shares have the cheapest valuation of all our Significant Six mega-cap tech stocks, which include Amazon, Apple , Microsoft , Meta Platforms and Nvidia.

The start of a New Year is a good time to scrutinize a portfolio and make some adjustments including adding undervalued stocks. Stocks that enjoyed big runs last year may cool off, requiring investors to search out securities they can buy low in hopes of eventually selling at a higher price.

It beat on both net interest income and noninterest income. And as we outline here, we suggest that you focus your research on the undervalued stocks of the companies on these lists. PrimeInvestor INH Undervalued Stocks. Ticker : LYFT. The company estimates that for each 0. You can find stock screeners at brokerages such as Fidelity, as well as on platforms like Morningstar and Yahoo Finance. FTSE 7, Target undervalued sectors. There may be a reason the stock is trading below value, and that reason may not be readily apparent. Additionally, exchange-traded funds ETFs centered on undervalued stocks India can be a convenient way to invest in a basket of such stocks that track a specific index. Tolani Investments INA Investing Ideas. Detailed volatility calculation methodology is available here.

I can not participate now in discussion - there is no free time. But I will be released - I will necessarily write that I think on this question.