Alice blue automated trading

Still new developers can refer the code for logic and functionality implementation in the live market. This algo trading bot is my first attempt to try, alice blue automated trading, learn and implement my python programming skills. Please use this only for reference and at your own risk. Initially, I had developed this for windows then later moved to linux ubuntu platform on AWS.

Algo Trading is nothing but a computer program that follows a particular trading strategy that places buy and sell orders. These orders are placed at a speed that cannot be matched by any human being. What is Algo Trading? It is nothing but a computer program that follows a particular trading strategy and places buy and sell orders. There are companies that provide ready-made Algo strategies or help you in coding your own strategies.

Alice blue automated trading

Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w. September 1, Corporate Office: No. Registered Office: Old No. Benefits: Effective Communication, Speedy redressal of the grievances. Click on the provided link to learn about the process for submitting a complaint on the ODR platform for resolving investor grievances. Investment in securities markets are subject to market risks, read all the related documents carefully before investing. Brokerage will not exceed SEBI prescribed limit. For queries regarding account opening or activation, email to [email protected] and for fund updates, email to [email protected]. Disclaimer : Prevent unauthorized transactions in your account. Issued in the interest of investors.

Investor Charter. Benefits: Effective Communication, Speedy redressal of the grievances. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.

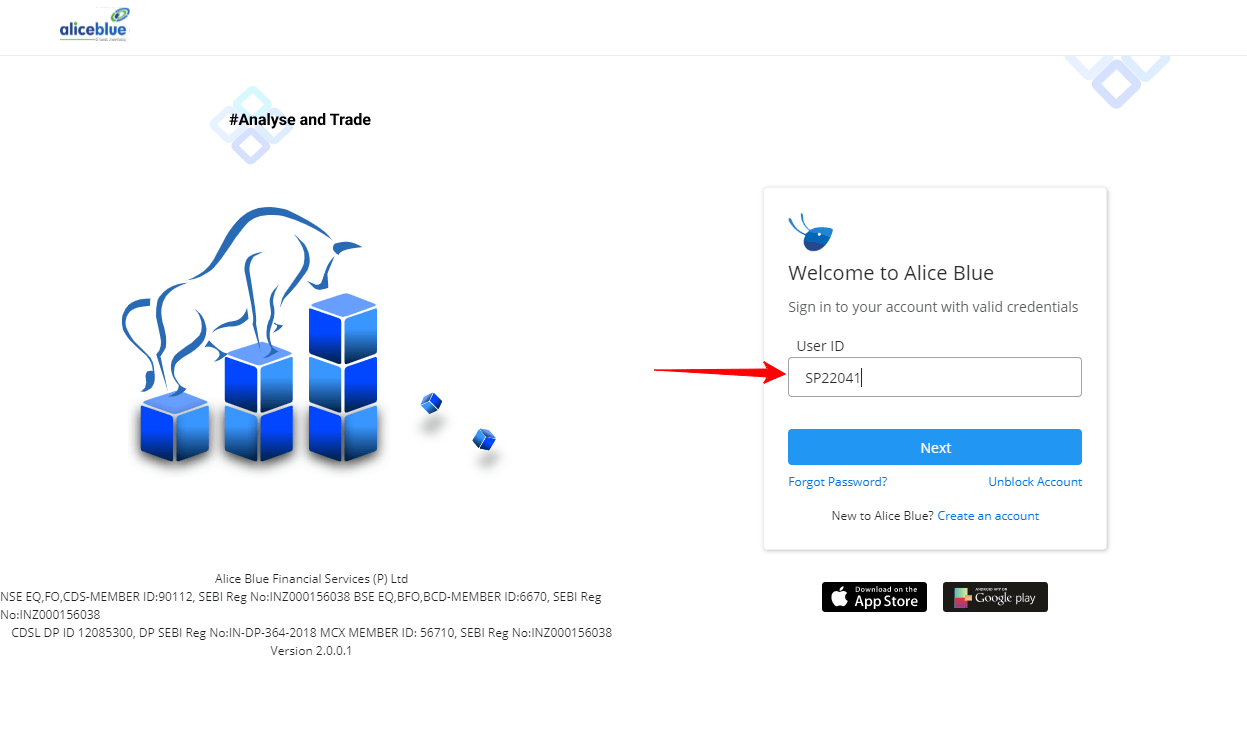

Open Instant Account online with Alice Blue and start trading today. It alsofacilitates the integration of your trading platform with third-party tools like MT4, Amibroker, or website to get data and punch orders. Alice Blue APIs provide a confidential key that helps traders establish a connection between their algorithm and Alice Blue's trading platform to obtain real-time market data and live market order placements. Alice Blue API is available free of cost. Alice Blue does not provide historical data API. ANT Plus API gives users programmatic access to the trading platform of Alice Blue that helps faster trade execution, multiple order placement, managing user portfolio, live market feeds, and much more. Alice Blue Interactive APIs are the trading APIs that help to place, modify, and cancel trading orders of different types like regular orders, after-market orders, basket orders, and bracket orders.

Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w. September 1, Corporate Office: No. Registered Office: Old No. Benefits: Effective Communication, Speedy redressal of the grievances. Click on the provided link to learn about the process for submitting a complaint on the ODR platform for resolving investor grievances.

Alice blue automated trading

Open Instant Account online with Alice Blue and start trading today. It alsofacilitates the integration of your trading platform with third-party tools like MT4, Amibroker, or website to get data and punch orders. Alice Blue APIs provide a confidential key that helps traders establish a connection between their algorithm and Alice Blue's trading platform to obtain real-time market data and live market order placements. Alice Blue API is available free of cost. Alice Blue does not provide historical data API. ANT Plus API gives users programmatic access to the trading platform of Alice Blue that helps faster trade execution, multiple order placement, managing user portfolio, live market feeds, and much more. Alice Blue Interactive APIs are the trading APIs that help to place, modify, and cancel trading orders of different types like regular orders, after-market orders, basket orders, and bracket orders. Alice Blue API can help users with algorithmic trading. Using Alice Blue API, you can convert your trading ideas into trading strategies and build your own algorithmic trading system for systematic trading using Alice Algo. The WebSocket API allows you to receive market data for multiple instruments across exchanges in the live market.

Free mahjong games no download full screen

Legal Documentation. Its a 4 digit pin of extra security or, You can call extra headache. Kick start your Trading and Investment Journey Today! Exchange Traded Funds India. Investment in securities markets are subject to market risks, read all the related documents carefully before investing. Alice Blue Special Offer. Alice Blue API Application Program Interfaces is a confidential key that allows you to establish a connection between your trading algorithm and Alice Blue's trading platform to obtain real-time pricing and place orders. September 1, For example, you decide to buy Nifty when it is trading at Related Posts. Latest commit History 52 Commits. What is Premarket Trading? Registered Office: Old No. Alice Blue Interactive APIs are the trading APIs that help to place, modify, and cancel trading orders of different types like regular orders, after-market orders, basket orders, and bracket orders. For queries regarding account opening or activation, email to [email protected] and for fund updates, email to [email protected].

.

You signed in with another tab or window. Information on this page was last updated on Thursday, November 23, Sign Up Now! For example, you decide to buy Nifty when it is trading at Open Free Demat Account. It also helps real-time order execution, access live market feeds, manage portfolios, and much more. Whenever these technical indicators give a buy or sell signal, the algo immediately places the orders and follows the potential trend. Best Discount Broker in India. And when the RSI is below 20, the stock is said to be in the oversold zone, indicating to buy. Open Account with Alice Blue. Live Data. An API connects a coded algorithm trading strategy and brokers trading platform. Its a 4 digit pin of extra security or, You can call extra headache. What is Commodity Trading? There may be costs for data feeds, fees for using software or platforms, and transaction fees charged by the brokerage.

Unequivocally, a prompt reply :)

Between us speaking, in my opinion, it is obvious. Try to look for the answer to your question in google.com