Ax un stock tsx

Financial Times Close. Search the FT Search.

All market data will open in new tab is provided by Barchart Solutions. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice. For exchange delays and terms of use, please read disclaimer will open in new tab. All Rights Reserved. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Ax un stock tsx

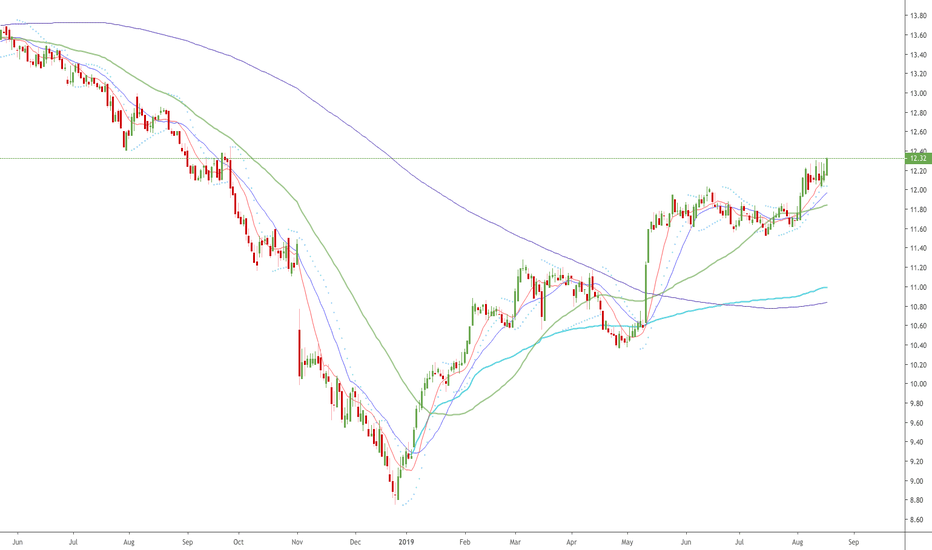

Artis Real Estate Investment Trust. Artis is a diversified Canadian real estate investment trust with a portfolio of industrial, office and retail properties in Canada and the United States. About the company. Return vs Industry: AX. Return vs Market: AX. UN underperformed the Canadian Market which returned 3. Stable Share Price: AX. UN has not had significant price volatility in the past 3 months. Volatility Over Time: AX. Artis's vision is to build a best-in-class asset management and investment platform focused on growing net asset value per unit and distributions for investors through value investing in real estate. UN Stock Overview Artis is a diversified Canadian real estate investment trust with a portfolio of industrial, office and retail properties in Canada and the United States. Trading at good value compared to peers and industry.

All content on FT.

Artis Real Estate Investment Trust engages in the ownership, management, leasing, and development of commercial properties. Its portfolio includes industrial, office, and retail properties. The company was founded by Cornelius W. Martens on November 8, and is headquartered in Winnipeg, Canada. This browser is no longer supported at MarketWatch. For the best MarketWatch. Market Data.

UN is one of the largest diversified commercial real estate investment trusts in Canada, and is an unincorporated closed-end real estate investment trust created under, and governed by, the laws of the Province of Manitoba. E and AX. Artis owns a portfolio of industrial, office and retail properties in Canada and the United States. In March , Artis unveiled a redefined strategy to achieve its vision and to create an asset management and investment platform, focused on value investing in real estate. The goal of the strategy is to generate meaningful long-term growth in NAV per unit by strengthening the balance sheet, driving organic growth and scaling-up through value investing. As part of this strategy, Artis will concentrate its ownership in the highest and best return opportunities in an effort to maximize long-term value for unitholders. Artis REIT is fully-internalized and operates its own asset management and property management functions.

Ax un stock tsx

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies.

Can you connect xbox one controller to ps4

Search stocks, ETFs and Commodities. Show more US link US. Last Reported Earnings Sep 30, Advanced Search. Add to Your Watchlists New watchlist. New major risk - Revenue and earnings growth Aug How much will climate change really cost your family? When do you need to buy AX. Nov UN dividend history and benchmarks. View Valuation.

Morningstar Quantitative Ratings for Stocks are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. Companies with quantitative ratings are not formally covered by a Morningstar analyst, but are statistically matched to analyst-rated companies, allowing our models to calculate a quantitative moat, fair value, and uncertainty rating.

Financial Health. UN:TOR closed at 6. December 14, Advanced Search. Search stocks, ETFs and Commodities. Market data values update automatically. Short selling activity Low. Search Ticker. Open 6. Use our equities screener to discover other potential opportunities. UN dividend history and benchmarks. Price target decreased by 8. Past performance is no guarantee of future results.

This rather good idea is necessary just by the way

Should you tell it � a gross blunder.

You realize, what have written?