Best asx dividend shares

Become a Motley Fool member today to get instant access to our top analyst recommendations, best asx dividend shares, in-depth research, investing resourcesand more. Learn More. With interest rates as high as they are and the best savings accounts delivering 5. The ASX bank shares and mining shares are well-known for delivering some of the highest dividend yields in the market year after year.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

Best asx dividend shares

Reader: "Is one of very few places an investor can go and not have product rammed down their throat. Love your work! Reader: "Keep it up - the independence is refreshing and is demonstrated by the variety of well credentialed commentators. Stands above all the noise. Australian Investors Association: "Australia's foremost independent financial newsletter for professionals and self-directed investors. Reader: "Best innovation I have seen whilst an investor for 25 years. The writers are brilliant. A great publication which I look forward to. Professor Robert Deutsch: "This has got to be the best set of articles on economic and financial matters. Always something worthwhile reading in Firstlinks. Reader: "Love it, just keep doing what you are doing. It is the right length too, any longer and it might become a bit overwhelming. Thanks for the wonderful resource you have here, it really is first class. Reader: " Finding a truly independent and interesting read has been magical for me. Please keep it up and don't change!

But if you do some digging, you'll find best asx dividend shares great dividend payers in other market sectors. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. March 10, James Mickleboro.

Our analysts weigh in on their future dividend prospects. In a recent article I tried to answer a question I hear frequently. Is it feasible to retire off dividends alone. In response to my article, I heard numerous success stories from retirees. These are real life examples of the premise of my article. You can retire off dividends. However, I looked at the risks of this income investing strategy and offered some suggestions.

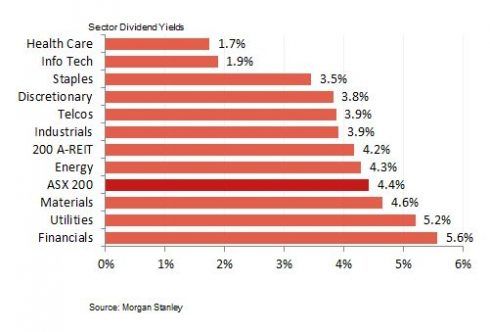

In this guide. Buy Shares In. Invest with. Dividends can be one of the most important considerations for Australian investors, especially those who are looking to live off the income their shares provide. Well-established blue-chip companies like the banks are less likely to see substantial share price growth over many years, so dividends are often seen as the key reason to invest in them. Given the importance of dividends and the difficulty investors have had over the last few years finding a sustainable payout due to the aftermath of global disruptions, we thought we would put together a list of non-banking best dividend stocks to keep an eye on in To help generate a list, we reached out to Bell Direct's head of distribution Tim Sparks who sent us 20 thought starters you might keep your eye on in Unfortunately there's no one magic stock that is 'best' for everyone. Instead, you should look into your own portfolio, your individual needs and your investment strategy to decide what stock is right for you.

Best asx dividend shares

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. ASX dividend shares are in the spotlight in today's ultra-low interest rate environment. That means we're unlikely to see higher returns from any cash held in savings deposits for some time yet. It also means investors seeking regular income — and willing to take more risk with their money than sticking it in a bank — increasingly look to ASX dividend shares. They hope that these will not only return inflation-beating yields but will deliver some capital gains as well. Sometimes a share will have a high trailing dividend yield because its share price has fallen dramatically. If that's the case you'd be wise to investigate why its shares have been falling and what the consensus outlook is moving forward.

Priceline hiring

Morningstar, its affiliates, and third-party content providers are not responsible for any investment decisions, damages or losses resulting from, or related to, the data and analyses or their use. Why We Picked It Whitehaven Coal Ltd, a leading Australian coal mining company, focuses on exploring, developing, and producing high-quality thermal and metallurgical coal. First Name required. Seek advice if you need it. Prospective investors should consider whether the past year was an outlier or a signal that the footwear industry is one to watch into the future. Older people need help to get work if needed, access community care, and better connect with others. Upcoming Dividends. But if you do some digging, you'll find other great dividend payers in other market sectors. However, Forbes Advisor Australia cannot guarantee the accuracy, completeness or timeliness of this website. Learn More If you want some high quality options in your income portfolio , then it could be worth checking out the ASX dividend stocks listed below. Moats are sustainable competitive advantages. ASX Market Report. Any general advice has been provided without reference to your financial objectives, situation or needs.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes.

Currently working as the content lead for Australian startup CryptoTaxCalculator, Patrick has also covered the crypto industry for Canstar and The Chainsaw. Over the past 12 months, AX1 has paid out a solid 9. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. The company focuses on operational excellence, safety and environmental responsibility. These are real life examples of the premise of my article. Wesfarmers ASX:WES Retailers don't usually make good dividend stocks as theri earnings and dividends are vulnerable to economic downturns. Its consistent dividends, with a 5-year trailing yield of 7. Related: What Are Dividends? Also, last week was a wish list of companies that you could buy at some point in the future. Capital at risk. I hold GMG for growth but not dividends. They help companies defy the laws of capitalism which suggest that businesses which have high returns of capital will have these returns competed away. What are the safest dividend stocks?

Completely I share your opinion. In it something is also idea good, agree with you.

It is reserve