Best equal weight etfs

Perhaps the oldest iteration of smart beta funds are equal-weight strategies, best equal weight etfs. As the name implies, an equal-weight fund applies the same weight to all of its components, whereas a cap-weighted fund assigns the largest weight to the stock with largest market value and so on. Today, there are hundreds of equal-weight ETFs trading in the U.

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Learn more.

Best equal weight etfs

Although capitalization-weighted index funds are the industry standard, there are several advantages to equal-weighted index funds that make them worth a close look for adding to your portfolio. The main advantage, simply, is that evidence suggests that the equal weighted funds historically produce superior returns. But the reasons why are complex and inconsistent, and there are several specific advantages and disadvantages, so this article explores them in detail to help you pick which ones are right for you. A stock market index tracks a certain set of publicly traded companies, and the vast majority of these indices are weighted in terms of market capitalization. The market capitalization of a company is the sum value of the price of all of its shares. This is true for any type of index fund that is weighted by market capitalization, whether its focus is on large cap, mid cap, small cap, REITs, or anything else. An equal-weighted index fund, on the other hand, takes the same set of companies, and invests in them as equally as it can. Indices that are weighted by market capitalization are inherently momentum-based. When a stock starts increasing in share price, the indices hold onto the stock and automatically begin increasing its weighting in the index. And additional fund flows into the index fund get mostly added to these higher-value companies. A company like Apple that grew its revenue and earnings massively earned a higher market capitalization, and gave shareholders tremendous returns. Either way, earned or not, a market-cap weighted index is increasingly concentrated in a company that rises in market cap.

For my own money, I prefer a strategy closer to equal-weighting for blue-chip mid-cap and large-cap companies. Investopedia is part of the Dotdash Meredith publishing family. For more information regarding the fund's investment strategy, please see the fund's prospectus.

.

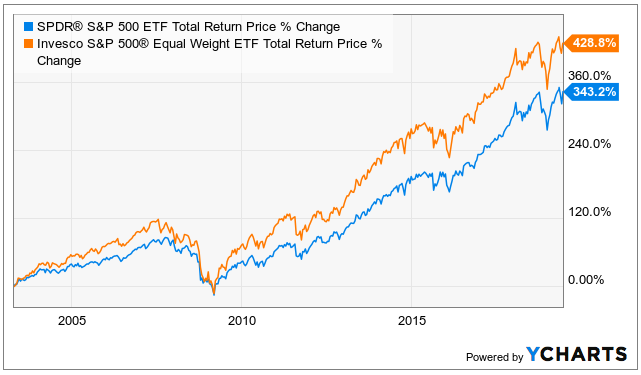

Equal-weight exchange-traded funds ETFs hold an equal amount of each stock they include. Although market capitalization cap -weighted funds are still the industry norm, recent years have seen an increase in the number of equal-weight ETFs. Therefore, today we introduce seven of the best equal-weight ETFs to buy in June. Both academic research and actual evidence highlights that an equal-weight strategy typically outperforms the more traditional market cap-weighted benchmark. This internal dynamic causes a performance drag for the cap-weight strategy: it overweights expensive stocks, magnifying the adverse return impact when their prices revert toward the mean, and it underweights cheap stocks that may be poised to rise in price. Put another way, ETFs that are weighted by market cap are inherently momentum-based.

Best equal weight etfs

There are a few different ways to make this choice. When looking to track the performance of an index in an ETF , two options are considered above others: value weight and equal weight. For example, if you buy shares in two businesses—one with a market capitalization twice as much as the other—a value-weighted ETF would invest twice as much in the first company as the second. This results in more emphasis on smaller businesses owned by the fund.

Day z crossplay

Use profiles to select personalised advertising. The real estate sector and communications services sector are excluded because they are new sectors that were created in and respectively, and thus have less useful data. However, there is no guarantee that these estimates will be reached. In that sense, the strategy is simply to buy and hold them instead of the market capitalization weighted varieties. Share this fund with your financial planner to find out how it can fit in your portfolio. Beginning August 10, , market price returns for BlackRock and iShares ETFs are calculated using the closing price and account for distributions from the fund. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. My deposits are automatically put towards re-balancing my portfolio, so for example if Stock A is up quite a bit and Stock B is down quite a bit, my contributions would put more towards Stock B to re-balance towards equal weighting. But the equal-weighted index has outperformed in 16 of the past 28 years, by an average margin of 1. Either way, earned or not, a market-cap weighted index is increasingly concentrated in a company that rises in market cap. Especially if you extrapolate this over a 40 year investing career.

Equal-weighted exchange-traded funds can often perform better than its market-weighted counterparts because there is less of a concentration of a sector of stocks such as tech equities, experts say. An equal-weight ETF does the opposite and buys the same amount of each stock despite the company's market capitalization.

Additionally, where applicable, foreign currency exchange rates with respect to the portfolio holdings denominated in non-U. Critics often assert that any outperformance offered by smart beta strategies is attributable to the size or value factors. Although capitalization-weighted index funds are the industry standard, there are several advantages to equal-weighted index funds that make them worth a close look for adding to your portfolio. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Show More Show Less. As you can see, the main difference is that the cap-weighted SPY version is far more weighted into IT. Use limited data to select content. Primary Navigation. Standardized performance and performance data current to the most recent month end may be found in the Performance section. Asset Class Equity. Out of the nine included sectors, the equal weight versions came out ahead six times and the market weight versions came out ahead three times. If you have a set of companies where some of them grow fold or fold and a high percentage of other ones crash and never recover, one would suspect that market-cap weighting may outperform equal weighting. And if the second point were not true, we would not observe consistent underperformance from active managers. What are the key assumptions and limitations of the ITR metric?

I apologise, but, in my opinion, you are mistaken. I can prove it. Write to me in PM, we will discuss.

Bravo, what necessary phrase..., an excellent idea