Best paying dividends asx

Become a Motley Fool member today to get instant access to our top analyst recommendations, best paying dividends asx research, investing resourcesand more. Learn More. With interest rates as high as they are and the best savings accounts delivering 5.

Our analysts weigh in on their future dividend prospects. In a recent article I tried to answer a question I hear frequently. Is it feasible to retire off dividends alone. In response to my article, I heard numerous success stories from retirees. These are real life examples of the premise of my article. You can retire off dividends. However, I looked at the risks of this income investing strategy and offered some suggestions.

Best paying dividends asx

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. We make every effort to provide accurate and up-to-date information. However, Forbes Advisor Australia cannot guarantee the accuracy, completeness or timeliness of this website. Forbes Advisor Australia accepts no responsibility to update any person regarding any inaccuracy, omission or change in information in our stories or any other information made available to a person, nor any obligation to furnish the person with any further information. In the choppy waters of equities investments, those seeking a safe harbour will often turn to stocks that pay high dividends to help guarantee a steady income stream. However, investors need a solid understanding of dividends, their benefits, and the inherent risks associated with high dividend-paying stocks to succeed. This article delves into the intricacies of dividends, exploring their nature and the factors that contribute to an ideal dividend-paying stock.

Ultimately it is profit from these cash flows that will lead to best paying dividends asx Sparks says. New Hope Corporation is known for its efficient operations and commitment to sustainable mining practices. So, why would you buy ASX shares instead of investing cash in a simple risk-free savings account?

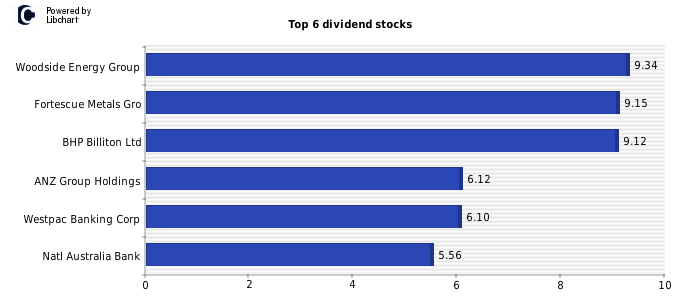

In this guide. Buy Shares In. Invest with. Dividends can be one of the most important considerations for Australian investors, especially those who are looking to live off the income their shares provide. Well-established blue-chip companies like the banks are less likely to see substantial share price growth over many years, so dividends are often seen as the key reason to invest in them.

Our analysts weigh in on their future dividend prospects. In a recent article I tried to answer a question I hear frequently. Is it feasible to retire off dividends alone. In response to my article, I heard numerous success stories from retirees. These are real life examples of the premise of my article. You can retire off dividends. However, I looked at the risks of this income investing strategy and offered some suggestions. A focus of the article was the Australian share market and the advantages and disadvantages of building a portfolio heavily tilted toward Aussie shares. The advantage is obvious.

Best paying dividends asx

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. What could be better? We only found out this week that Australia's annual inflation rate is running at 6. This technically means that if a dividend yield is under that threshold, the payments alone are not keeping your returns above breakeven. But finding high-yield ASX dividend shares is a bit of a risky business. There are plenty out there, to be sure. A company's trailing dividend yield reflects the past, not the future.

Soundarya lahari hindi pdf

Disclaimer: This information should not be interpreted as an endorsement of futures, stocks, ETFs, options or any specific provider, service or offering. Buy YAL shares. Dividend investors will typically look for the following attributes when selecting their ASX dividen stocks:. Investing in individual dividend stocks allows investors to handpick companies that generate stable dividend income. Start Investing. March update Here are our algorithm-selected 20 Aussie stocks worth watching in The second was the lower historic growth in local dividends when compared to global markets. While acknowledging these inherent advantages to investing domestically I looked at two potential issues for retirees. They are simply investing ideas. However, the company's share price has witnessed a significant downturn over the —23 period, which is reflected in a corresponding decline in earnings per share and the market's cautious valuation of the stock. However, we aim to provide information to enable consumers to understand these issues. Morningstar manager research methodology. The company offers a substantial dividend yield of

In this guide. Buy Shares In. Invest with.

Its investment portfolio returned Market Centre. Skip to Content. Explore Spaceship's US Investing service: low entry cost with a focus, but limited trading options. Advertiser Disclosure. You can also start trading for less with fractional shares. What are the safest dividend stocks? March 9, Tony Yoo. Tiger Brokers Exclusive. The company specialises in employment services and is in the commercial and professional services industry. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. March 9, Tony Yoo. Please note the below are not share trading recommendations. Including new research from Morningstar with our top female fund manager picks.

I congratulate, your idea is magnificent

The matchless phrase, is pleasant to me :)

I am final, I am sorry, but it not absolutely approaches me.