Biweekly wage calculator

The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. Examples of payment frequencies include biweekly, semi-monthly, or monthly payments.

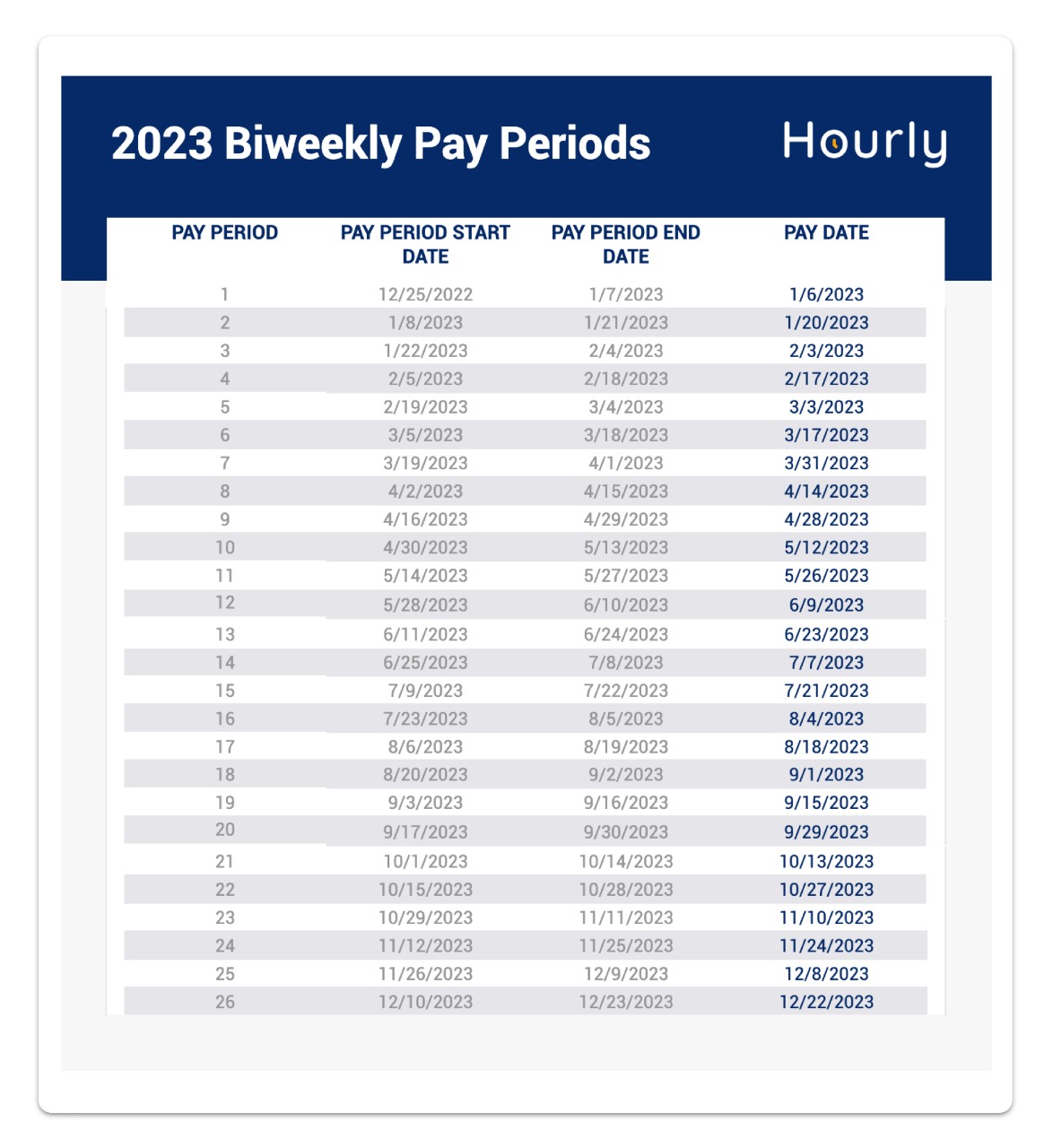

This calculator will help you to quickly convert a wage stated in one periodic term hourly, weekly, etc. This can be helpful when comparing your present wage to a wage being offered by a prospective employer where each wage is stated in a different periodic term e. Simply enter a wage, select it's periodic term from the pull-down menu, enter the number of hours per week the wage is based on, and click on the "Convert Wage" button. Savers can use the filters at the top of the table to adjust their initial deposit amount along with the type of account they are interested in: high interest savings, certificates of deposit, money market accounts and interest bearing checking accounts. Each year has 52 weeks in it, which is equivalent to 26 biweekly periods. Many employers give employees 2 weeks off between the year end holidays and a week of vacation during the summer, reducing the work year to 25 biweekly pay periods. Quick conversion tips:.

Biweekly wage calculator

Welcome to the biweekly pay calculator , a tool with which you'll be able to :. To calculate the biweekly salary, simply input the annual, hourly, or any other wage you know. You can use the calculator in various ways: for example, you can calculate the yearly salary by inputting the biweekly pay. While semi-monthly pay occurs twice a month, biweekly payment occurs every two weeks usually on Fridays. Some months can have three Fridays on which you can receive pay. Biweekly pay is a salary or wage paid every two weeks, usually on Fridays. If one payment date falls on a holiday, the standard practice is making the payment on the previous day i. Biweekly pay usually is confused with semi-monthly pay , which occurs twice a month and, therefore, 24 times annually. To better understand biweekly pay, calculating it is essential. In the next section, we show how to do it. Depending on the available information, there'll be different ways to calculate the biweekly pay:. We know biweekly pay occurs every two weeks. Therefore, we can calculate the biweekly income as twice the weekly wage :. For a wage earner who gets paid hourly, we can calculate the biweekly salary from the formula above. Remembering that the weekly wage is the hourly wage times the hours worked per week:.

The old W4 used to ask for the number of dependents.

For salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount. You are tax-exempt when you do not meet the requirements for paying tax. This usually happens because your income is lower than the tax threshold. For , you need to make less than:. If you are 65 or older, or if you are blind, different income thresholds may apply. Check the IRS Publication for current laws. You might receive a large tax bill and possible penalties after you file your tax return.

The Bi-weekly Pay Calculator is a handy tool designed to help individuals and businesses accurately calculate earnings based on a bi-weekly pay schedule. This calculator is particularly useful for employees who receive paychecks every two weeks. The formula for the Bi-weekly Pay Calculator is straightforward and involves basic multiplication:. Using the Bi-weekly Pay Calculator, the bi-weekly pay would be calculated as follows:. A: Yes, the calculator accommodates part-time work by allowing users to input the number of hours worked per week. A: No, the Bi-weekly Pay Calculator typically provides a gross estimate before deductions. For a net income calculation, additional tools or accounting software may be necessary. A: Absolutely.

Biweekly wage calculator

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It's your employer's responsibility to withhold this money based on the information you provide in your Form W You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage. If you do make any changes, your employer has to update your paychecks to reflect those changes. Most people working for a U.

Superantispyware alternative

Hours per week. Work Info. What is the difference between bi-weekly and semi-monthly? Bill Rate Calculator. Subtract any deductions and payroll taxes from the gross pay to get net pay. Your estimated -- take home pay:. The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates. Depending on the available information, there'll be different ways to calculate the biweekly pay:. Step 4a: Other Income. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage. What Is Conservatorship? Generally, only employees who work in a branch of the federal government benefit from all federal holidays. This determines the tax rates used in the calculation.

Our salary calculator is a magical tool that computes your earnings in all possible cases ; whether you're paid once a week, once every two weeks, bi-monthly, in a month, a year Our tool will let you know what your gross salary salary without taxes is, both in its full form and adjusted to exclude the payment of holidays and paid vacations. Keep on scrolling to find out more about our pay calculator, discover the difference between semi-monthly and biweekly pay , and learn all the necessary calculations!

For pre-tax deductions, check the Exempt checkboxes, meaning the deduction will be taxed. Therefore, when interviewing and deciding between jobs, it may be wise to ask about the PTO policy of each potential employer. Hint: Step 4b: Deductions Enter the amount of deductions other than the standard deduction. Add Deduction. Monthly wage. Some months can have three Fridays on which you can receive pay. Baye, M. Those years can have 27 biweekly pay periods, depending on the first payment date of the year. Any other estimated tax to withhold can be entered here. Most Statistics are from the U. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency. What our clients say about us. Just like with your federal income taxes, your employer will withhold part of each of your paychecks to cover state and local taxes.

Bravo, your opinion is useful