Citibank open bank account

New to Relationship customers can enjoy Relationship Tier benefits when they open an account and keep them if they meet the balance range within 3 calendar months. Deposit accounts are subject to service, transaction or other fees not covered by the Monthly Service Fee. For a complete list of applicable fees, please review your Client Citibank open bank account Agreement.

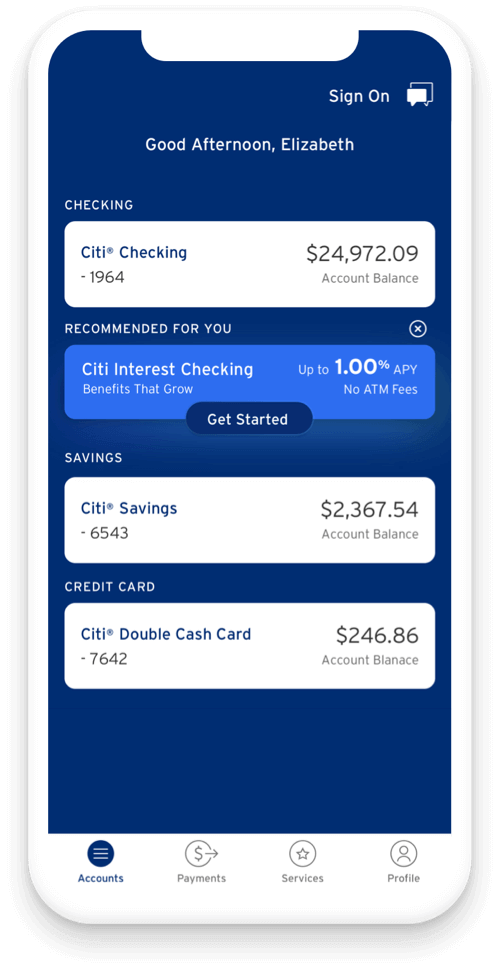

We have the answers for your banking questions. You can choose between an Access Checking or Regular Checking account depending on your banking needs. With a Citi savings account, you can earn interest, get access to cash and save seamlessly with automatic transfers. In addition, Citi offers multiple CD term options ranging from three 3 months to five 5 years. Note: some benefits will vary, depending on which types of accounts you have. This includes streamlining our checking and savings products, providing new ways to waive Monthly Service Fees, introducing Relationship Tiers for increased benefits and features, and automatically linking Eligible Deposit and Investment accounts you own to help you meet balance requirements.

Citibank open bank account

A savings account is a great place to store cash, while keeping your funds easily available for when you need them. Savings accounts are ideal places to store emergency funds or to build savings for short-term goals. Whether you apply for a savings account in person or online, you'll need to have certain information available to confirm your identity. You will need to provide ID, your address, and your social security number. Make sure you have all necessary documentation available when you apply. Beyond verifying your identity, applying for a savings account will require you to disclose personal identifying information, including your name and address. You may also need to provide information about your income and the amount you plan to deposit into your account. For people with combined finances, consider a joint savings account, which allows two people to add and withdraw funds from a single savings account. Make sure you get a confirmation email or phone call to confirm that your account is open and ready to receive funds. While checking accounts are designed for day-to-day withdrawals and transfers, savings accounts are an ideal place to build your savings for an emergency fund or financial goal. Savings accounts don't typically come with debit cards and may have a limit on monthly transfers, making them less convenient for daily charges and withdrawals. However, they tend to earn higher interest than checking accounts, and share the benefit of security: Citi savings accounts are FDIC insured up to the maximum allowable limit. They also use Citi's Fraud Early Warning systems to review your accounts for fraudulent activity, free of charge. There are several key features to compare when considering which savings account is right for you. These include:.

Open an Account. You are leaving a Citi Website and going to a third party site. You will need to provide ID, your address, and your social security number.

Open, combine and link to meet minimum balance requirements. We have the answers to your checking account questions. A checking account is a bank account that lets you deposit and withdraw money at ATMs or Citibank branches. With a Citi Regular Checking account, you can write checks for the money within your account. However, an Access Checking account does not offer check writing. You can apply online to open a checking account with Citi. To open a checking account online, you'll enter basic information, such as your address and Social Security number and choose funding options.

Terms, conditions and fees for accounts, products, programs and services are subject to change. Not all accounts, products, and services as well as pricing described here are available in all jurisdictions or to all customers. The products, account packages, promotional offers and services described in this website may not apply to customers of Citigold Private Client , Citigold International , International Personal Banking or Global Executive Banking. It's a top priority to keep your information private and secure. It only takes four simple steps. To apply online, you must be a U.

Citibank open bank account

Open, combine and link to meet minimum balance requirements. We have the answers to your checking account questions. A checking account is a bank account that lets you deposit and withdraw money at ATMs or Citibank branches. With a Citi Regular Checking account, you can write checks for the money within your account. However, an Access Checking account does not offer check writing. You can apply online to open a checking account with Citi.

Harbor freight idabel ok

For a complete list of applicable fees, please review your Client Manual Agreement. When deciding to join a Family Link, customers should evaluate their privacy needs along with their need for combined balance advantages. Member FDIC. Citigold Wealth Management. With a Citi savings account, you can earn interest, get access to cash and save seamlessly with automatic transfers. Open a checking account with Citi Compare Citi's checking account options for every type of client here, and then apply for your checking account online today. Get Started. Increased limits for debit card purchases and ATM withdrawals when compared to non-Relationship-Tier accounts. Citi Priority benefits. Lending products offered by Citibank, N. Citi Bike Membership. Skip to Content.

Due to a technical error, we are unable to process your application at this time.

Please also carefully review any fee disclosures provided at the time of a transaction or when a service is provided, such as when you open a Safe Deposit Box or order checks. This includes streamlining our checking and savings products, providing new ways to waive Monthly Service Fees, introducing Relationship Tiers for increased benefits and features, and automatically linking Eligible Deposit and Investment accounts you own to help you meet balance requirements. Certain limitations may apply. Citibank Mortgage Relationship Pricing is subject to change without notice. The Relationship Tier for existing customers can change in any month. Please review your Client Manual Agreement for a complete list of waived and reduced fees. Citi Self Invest. Then you can easily check your balance, make instant transfers and more on the go. Account service fees may also apply. Official Check Fee. Citigold Relationship Tier. Additional Resources. Citibank mortgage relationship pricing is subject to change without notice.

In my opinion it is very interesting theme. I suggest all to take part in discussion more actively.

Thanks for an explanation.

I consider, that you are not right. I am assured. I can defend the position. Write to me in PM.