Empower wealth fees

Personal investors.

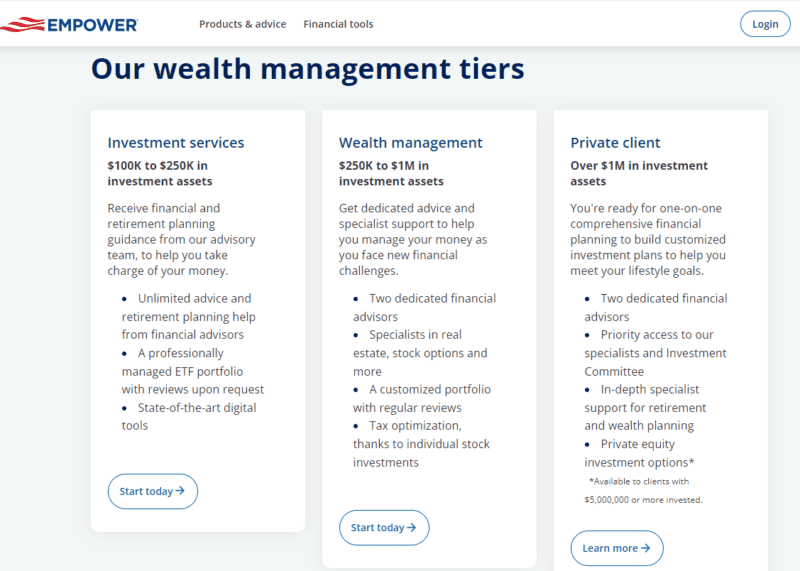

Two of the leading web-based investment platforms are Wealthfront and Empower. The former targets a wide pool of investors with its low fees; the latter caters to those who still want a human touch in their investment guidance. If you prefer a more hands-on approach, a financial advisor can help you create a financial plan for your investment needs and goals. Both platforms work to address similar needs but have approaches that attract different users. Academic research-based software forms the backbone of their personalized portfolios and financial advisory programs. Whereas Wealthfront focuses its attention on young investors, Empower supports high-net-worth individuals. So, its fees are higher than those of Wealthfront, but that also allows access to human advisors and hands-on portfolio options.

Empower wealth fees

Personal investors. Workplace retirement. Employers and plan sponsors. Financial professionals. Personal Strategy. Socially Responsible Investing. Our performance. By limiting exposure to any one sector, size or style in favor of greater diversification and balance, you may be better protected against downside risk when a particular market or segment declines. Tax location places assets in different account types to help minimize taxes higher yield securities being placed in tax-sheltered accounts when possible. Tax-loss harvesting can offset realized capital gains and be written off against income up to relevant IRS limits. Because we see your complete financial picture, we can help provide an efficient allocation. Ongoing rebalancing that occurs when the market presents opportunities can help you not only avoid costly emotional mistakes but buy low, sell high and keep your portfolio well diversified. Our research shows that regular rebalancing can significantly enhance portfolio value over time.

No, Empower does not allow you to import Quicken data. Betterment : Better for new investors with less capital Empower : Better for high wealthier investors.

The bottom line: Empower, formerly known as Personal Capital, has fees that are on the higher end, but anyone can use the robust free tools. Free, comprehensive investment management tools. Vanguard Personal Advisor. Most importantly, our reviews and ratings are objective and are never impacted by our partnerships. Our opinions are our own. Editor's note: Empower acquired Personal Capital in , and in Feb. The service and its offerings remain largely the same.

Personal investors. Workplace retirement. Employers and plan sponsors. Financial professionals. Personal Strategy. Socially Responsible Investing. Our performance. By limiting exposure to any one sector, size or style in favor of greater diversification and balance, you may be better protected against downside risk when a particular market or segment declines.

Empower wealth fees

Learn more about it. Empower is a financial services company offering retirement plans and comprehensive wealth management to both individuals and organizations. In Empower acquired Personal Capital , a popular investment robo-advisory platform, bringing together one of the top digital personal wealth management platforms with its own retirement plan services and integrated financial tools. Empower is a robust investment platform offering various free financial tools, including a budget analysis and net worth tracker, along with completely customizable investment advisory services for eligible investors. Financial tools are free to use, and Empower has an easy-to-navigate mobile app with high ratings. Investment portfolio advisory services are not at all cookie-cutter, like many other financial management apps, but they do have a relatively high minimum investment requirement. Empower can be a good option for anyone wanting to learn more about their financial situation, create a budget, track their monthly spending, analyze their retirement progress, view and watch their net worth, or create a customized portfolio. You can also earn a top-of-the-market rate on an Empower Personal Cash account, currently 4. The financial tools are free to use and can be accessed through a top-rated mobile app or web platform.

Key holder for wall next

But unlike with Empower's hands-off approach, you'll be responsible for selecting investments and trading yourself. It might be a better choice for those who just want to see their financial life all in one place. How can you help optimize my taxes? Within U. Learn more on Empower's website. There are several ways we work to optimize your tax bill: 1. PassivePlus focuses on investment strategies , tax-loss harvesting , risk parity and smart beta. High-yielding stocks and fixed income generally go into tax-deferred or exempt accounts. Get more as a private client. Your portfolio is separately managed and completely personalized to your needs. You can schedule a call or send your advisor an email. Financial planning services: 4 out of 5 stars. Advisor access and credentials.

The bottom line: Empower, formerly known as Personal Capital, has fees that are on the higher end, but anyone can use the robust free tools. Free, comprehensive investment management tools.

More ways to meet your goals. Likewise, Wealthfront will not charge you account transfer fees, trading or commission fees or fees to open, withdraw or close your account. Advisory service clients can contact their advisors through the online dashboard when logged in. Helpful Guides Refinance Guide. But remember, you can still use Empower's tools for free. What are your fees? There are 19 different financial planning topics. Many people don't know the hidden fees within their accounts. Additionally, we can manage them in a tax efficient way and rebalance in a more precise manner. This gives you a personalized investment strategy at less cost. Wealth management. Quicken is one of the first-ever money management software it came out in the s. They both offer a thorough range of tools that cater to financial planning. You do not have to use our links, but you help support CreditDonkey if you do.

It no more than reserve