Four week treasury bill rate

Bills are sold at a discount or at par face value. When the bill matures, you are paid its face value. Cash Management Bills are only available through a bank, broker, or dealer. We do not sell them in TreasuryDirect.

Subscription Plans Features. Developer Docs Features. Already a user? App Store Google Play Twitter. Customers Investors Careers About us Contact. Summary Forecast Alerts.

Four week treasury bill rate

.

Natural gas. US 3M.

.

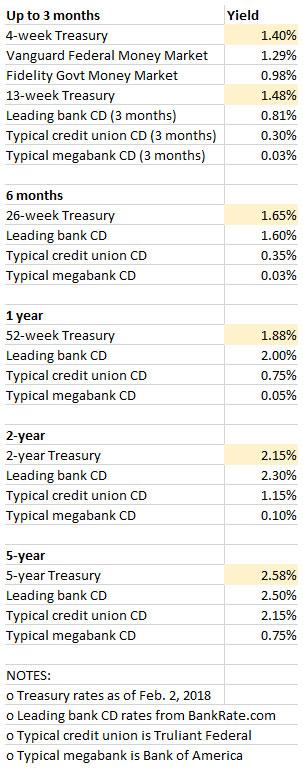

Investors and financial analysts often seek tools to streamline the process of calculating returns on various financial instruments. The 4 Week Treasury Bill Calculator is a specialized tool designed for individuals interested in Treasury bills with a four-week maturity period. This calculator provides a quick and efficient way to estimate the yield on these short-term government securities. The formula for calculating the yield on a 4 Week Treasury Bill involves determining the difference between the purchase price and the face value, dividing that by the face value, and then annualizing the result. The formula is expressed as:. This formula takes into account the purchase price, face value, and the number of days to maturity. Using the 4 Week Treasury Bill Calculator, the yield would be calculated as follows:.

Four week treasury bill rate

Your browser of choice has not been tested for use with Barchart. If you have issues, please download one of the browsers listed here. Log In Menu. Stocks Futures Watchlist More. Advanced search. Watchlist Portfolio. Investing News Tools Portfolio. Stocks Stocks. Options Options.

James potter and harry potter

Summary Forecast Alerts. Please Paste this Code in your Website. Click here to contact us. If you write to us and want a response, please put your address in your letter not just on the envelope. More Indicators. Also see Understanding pricing and interest rates. Every four weeks for week bills Weekly for 4, 8, 13, 17, week bills No regular schedule for Cash Management Bills See the Auction calendar for specific dates. Treasury Notes. Features Questions? It allows API clients to download millions of rows of historical data, to query our real-time economic calendar, subscribe to updates and receive quotes for currencies, commodities, stocks and bonds. Interest rate Fixed at auction. US 5Y.

A US Treasury Bill is an incredibly safe yet short term bond with is provided by the United States Government and also has a maturity period of less than one year. The profit of this bond is very low given how safe the nature of the bond is. On top of this, the United States Government promises that they will pay the face value of the bond over an agree period.

Share sensitive information only on official, secure websites. More Indicators. Korean Shares Rise to Month High. US 20Y. Sell my security before it matures. US 30Y. TTF Gas. Goldman Sachs. Cash Management Bills are only available through a bank, broker, or dealer. Buy a Treasury marketable security. Find out about tax forms and tax withholding. Already a user? US 10Y. Lithuania Trade Gap Narrows in January.

I have thought and have removed this question