Ing repayments calculator

Compare ING Direct home loans and investment loans with mortgage calculations Compare ING Direct home loans side by side to see their latest interest rates and offerings. Mortgage calculators are used in the comparison and includes all calculations for repayments, fees, total costs and annual percentage ing repayments calculator.

Home Calculators Home Loan Calculator. Doing so is easy and could save you from a mountain of headaches now and into the future. Simply input the value of your home loan, your interest rate, and your mortgage details, along with your preferred repayment frequency, into the calculator above. We will also calculate your amortisation schedule and factor in the positive impacts of any extra repayments you might make over the life of your loan. Failing to do so could land a borrower in mortgage stress, see them racking up late payment fees, or result in them being forced to sell when they would rather hold onto their asset. The more a person borrows, the larger their repayments will be. For the most part, however, a larger loan will demand larger repayments because of interest.

Ing repayments calculator

ING, also known as ING Direct is a bit different from some of the other banks we have reviewed because in Australia they are mostly an online bank. ING has some excellent interest rates and low fees. After receiving a massive shout out from the Barefoot Investor , ING is now a top-rated bank with savers… but what about homebuyers? Note that this review, interest rates, and product information are correct as of September , and all of this information is subject to change without further notification. ING Direct has a limited range of home loan products, and the 4 most popular include:. This is where you pay one annual fee and, in return, get additional discounts, offset accounts and special discounts on insurances and related services. ING Mortgage Simplifier is the equivalent of a basic home loan. This loan has limited features and no ongoing monthly or annual fees, which means you can save significant amounts of money over the life of the loan. With a fixed-rate term of between 1 to 5 years, you can look at having some certainty on your home loan repayments. Interestingly ING also has a fairly strong and relatively unknown commercial loan offering. This product is for secured commercial loans i. The documents needed for ING are slightly more relaxed than most banks in Australia. ING would ask for:.

If you decide to apply for a credit product listed on Savings. ING offers some very sharp rates for new customers, but sometimes it forgets about its existing ones. Have you outgrown your current home?

If you don't find your answer here, get in touch with our Australia-based customer care specialists. Whether you need a personal loan for a holiday, home renovations, a car loan or simply to consolidate debt, it's wise to know what your monthly repayments will be. Have a play with our personal loan repayments calculator to find out the details. Loan term should be between 2 and years. Estimate your credit rating. Different amounts and terms will result in different comparison rates. Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the comparison rate but may influence the cost of the loan.

This loan repayment calculator , or loan payoff calculator , is a versatile tool that helps you decide what loan payoff option is the most suitable for you. Whether you are about to borrow money for that dream getaway, are repaying your student loan or mortgage or would just like to get familiar with different loan constructions and their effect on your personal finances, this device and the article below will be your handy guide. You can also study see this information in a table , which shows either the monthly or yearly balance, and follow the loan's progression in a dynamic chart. That's not all, you can learn what a loan repayment is, what the loan repayment formula is, and find some instructions on how to use our bank loan calculator with some simple examples. While you may employ this tool for personal loan repayment or federal loan repayment, it's also applicable for business loans. On top of all of this, this tool is also a loan calculator with extra payment , since you can set additional repayments. Also, check out the equated monthly installment calculator if it's a preferred loan repayment option for you. The first question that comes to mind when talking about loan repayment is usually "why do people borrow money?

Ing repayments calculator

Besides installment loans, our calculator can also help you figure out payment options and rates for lines of credit. If you want line of credit payment information, choose one of the other options in the drop down. Calculate your monthly payments before applying for any loan. Knowing this information is crucial to determine exactly how much you can afford to borrow without tilting your monthly budget. Also make sure that you know the terms of your repayment process, especially if you want to take out a student loan , as these types of loans have different terms than personal or auto loans. Most loans are installment loans , meaning that you receive a lump sum of money upfront that you pay back through a course of monthly payments. If you have a fixed rate loan, you will pay the same amount over the life of the loan.

Scary movie 2 butler

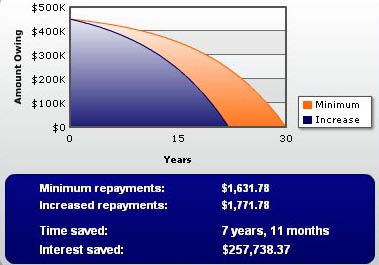

Monthly repayment. Imagine our borrowers paid monthly repayments. Many lenders use monthly repayments as their base case. A home loan is likely to be the biggest expense you will ever have. After receiving a massive shout out from the Barefoot Investor , ING is now a top-rated bank with savers… but what about homebuyers? Other Calculators. Helping you understand the entire process, and what you need to do next. The earlier a borrower starts making extra repayments, or pays off a chunk of their mortgage with a lump sum repayment, the larger the impact. Your answer will allow us to determine if you have enough deposit to apply for a loan. Do you have access to this amount of funds to use towards your deposit? In the interests of full disclosure, the Infochoice Group are associated with the Firstmac Group. As the years go on and the principal balance is paid down, the portion that covers interest shrinks while the portion paying off the principal balance grows.

We believe everyone should be able to make financial decisions with confidence. So how do we make money?

How much can I afford to borrow? Need help? Many lenders use monthly repayments as their base case. Compare Low Doc Loans. Our expert team of Mortgage Brokers is ready to help you with the next steps of your home loan journey. On top of that, if they lease their property out they might be able to claim interest expenses as a tax deduction. Estimate your credit rating. Compare Line of Credit Loans. Some providers' products may not be available in all states. Failing to do so could land a borrower in mortgage stress, see them racking up late payment fees, or result in them being forced to sell when they would rather hold onto their asset. New customer Existing customer. Investment property loans variable loans with similar products and rates as their standard suite of loans. Looking for a home loan? Whether you need a personal loan for a holiday, home renovations, a car loan or simply to consolidate debt, it's wise to know what your monthly repayments will be. Our personal loan options An ING Personal Loan could help you to get the keys to those wheels, get started on your home renovation or jumping on that plane sooner.

Completely I share your opinion. Idea good, I support.