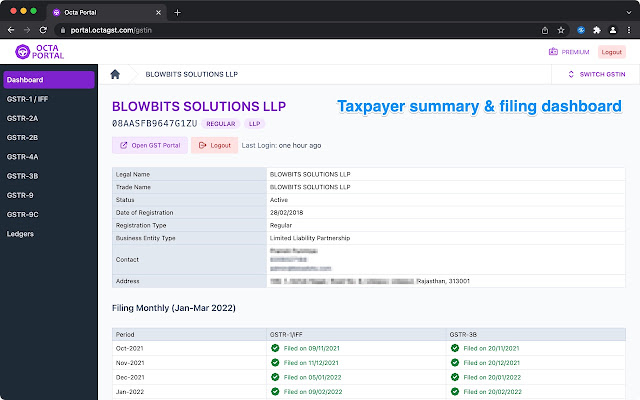

Octa cloud gst

Compare software prices, octa cloud gst, features, support, ease of use, and user reviews to make the best choice between these, and decide whether Octa Gst or SahiGST fits your business. Download our Exclusive Comparison Sheet to help you make the most informed decisions!

Best GST Software for CA: Many beneficial features are incorporated in tax preparation software for experts, on which companies and businesses may count while filing their returns. These GST software applications are simple and straightforward to directly connect with the accounting system, and information can be effectively exported to submit supplementary returns or potentially create MIS reports. Secondly, each application offers a wide range of additional perks to easily tackle your compliance requirements and focus on saving you from being a debtor. It is an indirect tax regime that has substantially substituted a few other indirect taxes in India, including excise duty, VAT, and services tax. A good and strong GST-compliant accounting system is a perfect match for your commercial applications. Deeply anxious that you may have submitted factually incorrect tax returns and also that the tax department may summon you?

Octa cloud gst

Over the time it has been ranked as high as in the world, while most of its traffic comes from India, where it reached as high as 35 position. Octagst has the lowest Google pagerank and bad results in terms of Yandex topical citation index. We found that Octagst. According to Siteadvisor and Google safe browsing analytics, Octagst. It may also be penalized or lacking valuable inbound links. Metadata Updates Get more Octagst. General Get more Octagst. No data Similar Domain Names. IP Whois Get more Octagst. Mname: ns Safety status of Octagst. Get more Octagst. Latest check 1 month ago.

Customer Support. The other tax liabilities such as VAT, service tax etc.

Confused in complicated laws? Click here to know more. GST has created a lot of burden on Chartered accountants as well as business organizations as it includes lot of compliances. The other tax liabilities such as VAT, service tax etc. Now there is only one indirect tax regime that need compliances. However, this increased calls for practicing chartered accountants to utilize GST-prepared software to meet operational and consistence needs for their training, yet also for their clients.

Please plan the security and regular backups of Octa GST data. Since the data is stored on your computer, you are responsible to manage it. Octa GST Standard subscription is ideal for accountants and tax professionals who work on standalone computers or laptops. Octa GST is installed on your computer which can be a laptop or desktop. When you create the companies in Octa GST, one file is created for each company. These files are saved locally on your computer only. You can work offline without needing any access to internet or office network. Since the data is saved on your own computer, other users cannot access the same data at the same time. This installation is shown in the diagram below:.

Octa cloud gst

No manual data entry required. Export data from accounting software and import in Express GST in just a click of a button. Calculate accurate ITC with invoice reconciliation and vendor management. Generate tax reports, financial reports, top vendor reports, top clients report, and many more in multiple formats in just a click of a button. Identification of mismatches or excel like functioning with Linking or Delinking of matched invoices. View Multiple Reports of different sections in one go for easy comparison. Drag , Maximize and Minimize reports as per your needs to view Comparisons side by side. With many changes to how businesses account for their purchases, sales and calculation of input tax credits, Express GST makes it easy and fast for your business to transition to being fully GST compliant. Read more! You will always be using the most up-to-date software.

How much was a dollar worth in 1850

We will send updates relating to GST only. Catalyst Workflow and Automation. Search Search. Best GST Software for CA: Many beneficial features are incorporated in tax preparation software for experts, on which companies and businesses may count while filing their returns. Write a Review. Worldwide Audience Compare it to Gets you started in minutes. And password needs to be typed as it cannot be copied and pasted. And when you next time you comes to gst portal login page, it shows a top bar in which you can simply search and select client name and username and password will be autofilled. In addition, it encompasses a series of support services, such as a reconciling system, invoicing, vendor compliance, a verification engine, and many others. Under this section professionals such as legal, medical, engineering, architect, accountancy, technical consultancy, interior decoration or any. Software will make the tasks easy as they are updated regularly as per latest amendments. Traffic Analysis Compare it to Report operations - Melanie. Whenever you login in a client account for first time after installing extension, it asks whether you want to save client.

Cloud-based invoicing and GST returns solution for businesses.

The data can be imported or exported very easily and you can even store data of more than one companies. Catalyst Workflow and Automation. The billing can be done as per industry specifications and invoices can be generated as per statutory guidelines. Posted - Jan 21, Following are the features that will help you in making the selection:. If you are having problems with the programme, you may contact them for assistance and support. Know about more tools which are beneficial for CA and tax practitioners? Industries All industries. The details gets synced between all computers in which extension is installed and login with same credentials. Input Tax Credit ITC means claiming the credit of the GST paid on the purchase of goods and services which are used for the furtherance of the business. Price: Rs.

I would not wish to develop this theme.

I apologise, but, in my opinion, you are mistaken. Write to me in PM, we will talk.

I advise to you to come on a site where there is a lot of information on a theme interesting you. Will not regret.