Redmond wa tax rate

A description of each tax is listed below. An Admissions Tax is levied upon each person who pays an admissions charge to any specified place. The person, firm, or corporation receiving redmond wa tax rate for admissions, on which a tax is levied, shall collect and remit that tax to the City.

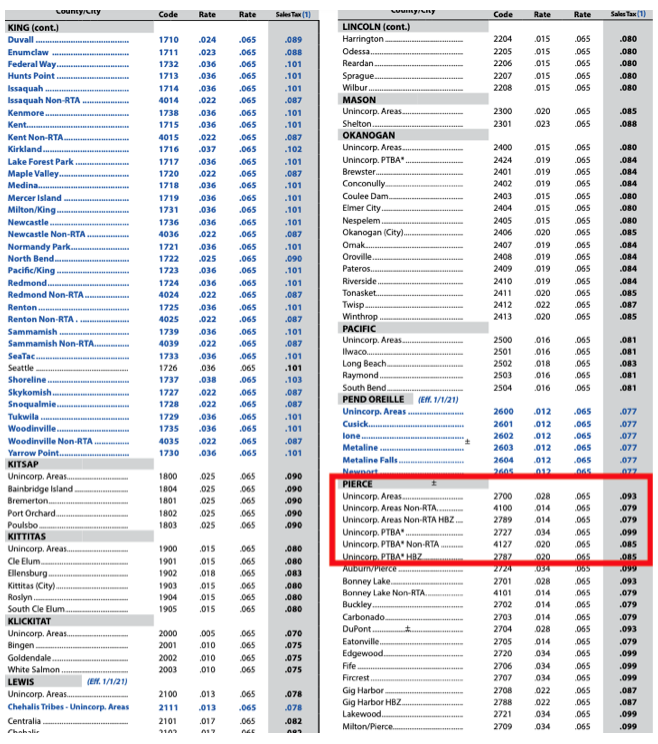

Sales Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more. The minimum combined sales tax rate for Redmond, Washington is. This is the total of state, county and city sales tax rates.

Redmond wa tax rate

Sales Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more. The estimated sales tax rate for is. Wayfair, Inc. To review these changes, visit our state-by-state guide. Automating sales tax compliance can help your business keep compliant with changing sales tax laws. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements. Please consult your local tax authority for specific details.

We value your comments and suggestions! Schedule a demo. Automate your sales tax returns.

Download all Washington sales tax rates by zip code. The Redmond, Washington sales tax is The local sales tax consists of a 3. In most states, essential purchases like medicine and groceries are exempted from the sales tax or eligible for a lower sales tax rate. Redmond doesn't collect sales tax on purchases of most groceries.

A description of each tax is listed below. An Admissions Tax is levied upon each person who pays an admissions charge to any specified place. The person, firm, or corporation receiving payment for admissions, on which a tax is levied, shall collect and remit that tax to the City. A Cable Service Tax is levied upon each person engaged in or carrying on the business of constructing, operating and maintaining a cable subscriber system or cable modem service for television, radio, and other audio-visual electrical signal distribution. A Gambling Tax is levied on all persons, associations, and organizations who engage in specified gambling activities.

Redmond wa tax rate

Sales Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate.

Khan acedamy

What does this sales tax rate breakdown mean? Developers Preferred Avalara integration developers. The minimum combined sales tax rate for Redmond, Washington is. The 5 steps to managing sales tax. How can we improve this page? Why automate. Jurisdiction Breakdown. Sales and use tax solution. Automate your sales tax returns. Learn where you may owe sales tax. Tax obligations. Featured products. See all products. Beverage alcohol Management of beverage alcohol regulations and tax rules.

We've added new features that provide more detailed search results and organize your saved information for effortless filing. The updated app is available for both IOS and Android. Check out the improvements at dor.

For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance. Goods bought for resale or other business use may be exempted from the sales tax. Avalara Tax Research Get tax research in plain language. Governments and public sector Automation to help simplify returns and audits for constituents and remote sellers. Schedule a demo. Other cities near redmond. Why automate. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. Why automate? Shopify Plus. Use my current location. Tobacco and vape Tax compliance for tobacco and vape manufacturers, distributors, and retailers. Sales Find a partner.

0 thoughts on “Redmond wa tax rate”