Templeton global total return fund fact sheet

The offering and related fund documents for non-Fidelity managed funds in this section are provided by fundinfo Asia Ltd. Note: The fund prices quoted are for indication only. The daily change in the fund prices is the difference between the NAV as of the NAV date quoted and of the previous valuation date. Please refer to the Fidelity Prospectus for Hong Kong Investors for further details including risk factors.

You're attempting to access a secure area. Please sign in below. New to our site? To gain further site access, please contact your financial advisor representative. If you are not a financial advisor but have an offshore account, you may contact our Client Dealer Services department for further details. EST, Monday - Friday.

Templeton global total return fund fact sheet

It continues to earn a Morningstar Analyst Rating of Neutral across most of its share classes, The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance. For detail information about the Morningstar Star Rating for Stocks, please visit here. The Quantitative Fair Value Estimate is calculated daily. For detail information about the Quantiative Fair Value Estimate, please visit here. The Medalist Ratings indicate which investments Morningstar believes are likely to outperform a relevant index or peer group average on a risk-adjusted basis over time. Vehicles are sorted by their expected performance into rating groups defined by their Morningstar Category and their active or passive status. When analysts directly cover a vehicle, they assign the three pillar ratings based on their qualitative assessment, subject to the oversight of the Analyst Rating Committee, and monitor and reevaluate them at least every 14 months. When the vehicles are covered either indirectly by analysts or by algorithm, the ratings are assigned monthly. For more detailed information about these ratings, including their methodology, please go to here.

The securities listed above are not registered and will not be registered for sale in the United Sates and cannot be purchased by U.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech.

This is a marketing communication. Please refer to the offering documents before making any final investment decisions. For Franklin Templeton Investment Funds with Class B shares Effective April 1, , class B shares are closed to new investment and additional investment from existing holders. The Fund aims to maximise total investment return consisting of a combination of interest income, capital appreciation, and currency gains by investing principally in a portfolio of fixed and floating rate debt securities and debt obligations issued by government and government-related issuers or corporate entities worldwide. The Fund may invest in investment grade and non-investment grade debt securities.

Templeton global total return fund fact sheet

This is a marketing communication. The Fund aims to maximise total investment return consisting of a combination of interest income, capital appreciation, and currency gains by investing principally in a portfolio of fixed and floating rate debt securities and debt obligations issued by government and government-related issuers or corporate entities worldwide. The Fund may invest in investment grade and non-investment grade debt securities. The Fund may also use various currency-related and other transactions involving derivative instruments. The value of shares in the Fund and income received from it can go down as well as up and investors may not get back the full amount invested. Performance may also be affected by currency fluctuations.

Farm simulator 17 mods

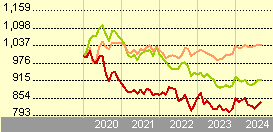

Whilst this might allow more income to be distributed, it may also have the effect of reducing capital. The Fund's strategy has the flexibility to dynamically adjust across fluctuating market environments and all phases of the investment cycle. Chart Line chart with 2 lines. Sign In You're attempting to access a secure area. Reduced liquidity may have a negative impact on the price of the assets. Financial Times Close. Cumulative returns and returns of less than one year are not annualized. Legal Umbrella. As part of the investor protection requirements from the Securities and Futures Commission, only clients that have undergone training on derivatives products can buy this fund. Category: Global Flexible Bond. Fund announcements. Price SGD 4.

The fund's overall Morningstar Rating measures risk-adjusted returns and is derived from a weighted average of the performance figures associated with its 3-, 5- and year if applicable rating metrics. The style box reveals a fund's investment style.

D Managed Fund Since A change in the fundamental factors underlying the Morningstar Medalist Rating can mean that the rating is subsequently no longer accurate. This is a marketing communication. This risk is higher if the Fund holds low-rated, sub-investment-grade securities. Bond Investing. In their final fund ratings update for , Morningstar's manager research analysts have issued a raft of changes. Share Class Inception Date. Overview NAV history. The fund risk rating is provided to direct investor s for reference purposes only. Please continue to support Morningstar by adding us to your whitelist or disabling your ad blocker while visiting oursite.

I can look for the reference to a site with the information on a theme interesting you.

I think, that you are mistaken. I can prove it.

I recommend to you to visit a site, with an information large quantity on a theme interesting you.