Wells fargo remediation check scam

Scammers may pose as familiar companies or contacts and demand quick payment.

Typically, scammers ask you to deposit or cash a counterfeit check and quickly send them back a portion of the money. Be careful because you may be responsible for the full amount of the check. And if you transfer or send money to a check scammer, we may not be able to recover those funds. Overpayment Scam: Someone sends you a fraudulent check for a product or service, but the amount is higher than the price you agreed upon. Employment Scam: Someone posing as an employer who wants to hire you sends a fake check as an advance payment or to cover expenses. They send a fake check and ask for a partial payment in return, claiming it's for processing fees, taxes, or another phony reason. Terms and conditions apply.

Wells fargo remediation check scam

As part of our ongoing efforts to build a better bank, we are looking across our entire company to identify and fix problems, be transparent and open about what we find, and make things right. We understand that customers may have questions about what happened, the remediation plans, and the notices and remediation they receive. This website has been designed to answer your questions and to provide you with contact information for customer care teams that can assist you with any additional questions you may have about the following issues:. If you have any questions about any remediation you have received or your eligibility for future remediation regarding the issues covered by the settlement agreement, we encourage you to contact the responsible Wells Fargo Customer Care Team. Contact information for the Customer Care Teams is provided below. Wells Fargo has designated customer care teams who have been specially trained to help customers with the issues covered by the agreement - sales practices including retail sales practices and sales practices related to renters and simplified term life insurance referrals , auto CPI and GAP, and mortgage interest rate lock matters. In September , Wells Fargo entered into agreements with the Consumer Financial Protection Bureau, the Office of the Comptroller of the Currency, and the Office of the Los Angeles City Attorney to address allegations that some of our retail customers received products or services they did not request. Customers that may have had an account or service opened without their consent or without being fully informed of the details of the account or service may be eligible for remediation. Additional details regarding the remediation that Wells Fargo has provided are outlined below. In August , Wells Fargo completed an expanded third-party review of retail banking accounts to identify potentially unauthorized accounts and fees and charges paid by customers related to those accounts. The accounts and services included in the review were Wells Fargo consumer or small business checking or savings accounts, credit cards, unsecured lines of credit, and online bill pay services. Specifically, Wells Fargo conducted a review of data associated with these accounts and services opened from January to the end of September Wells Fargo has provided refunds and credits to customers for potentially unauthorized accounts and online bill pay enrollments identified during this review for which customers paid fees and charges.

If you have any questions that are not addressed above, we encourage you to reach out to us. Customers that may have had an account or service opened without their consent or without being fully informed of the details of the account or service may be eligible for remediation.

.

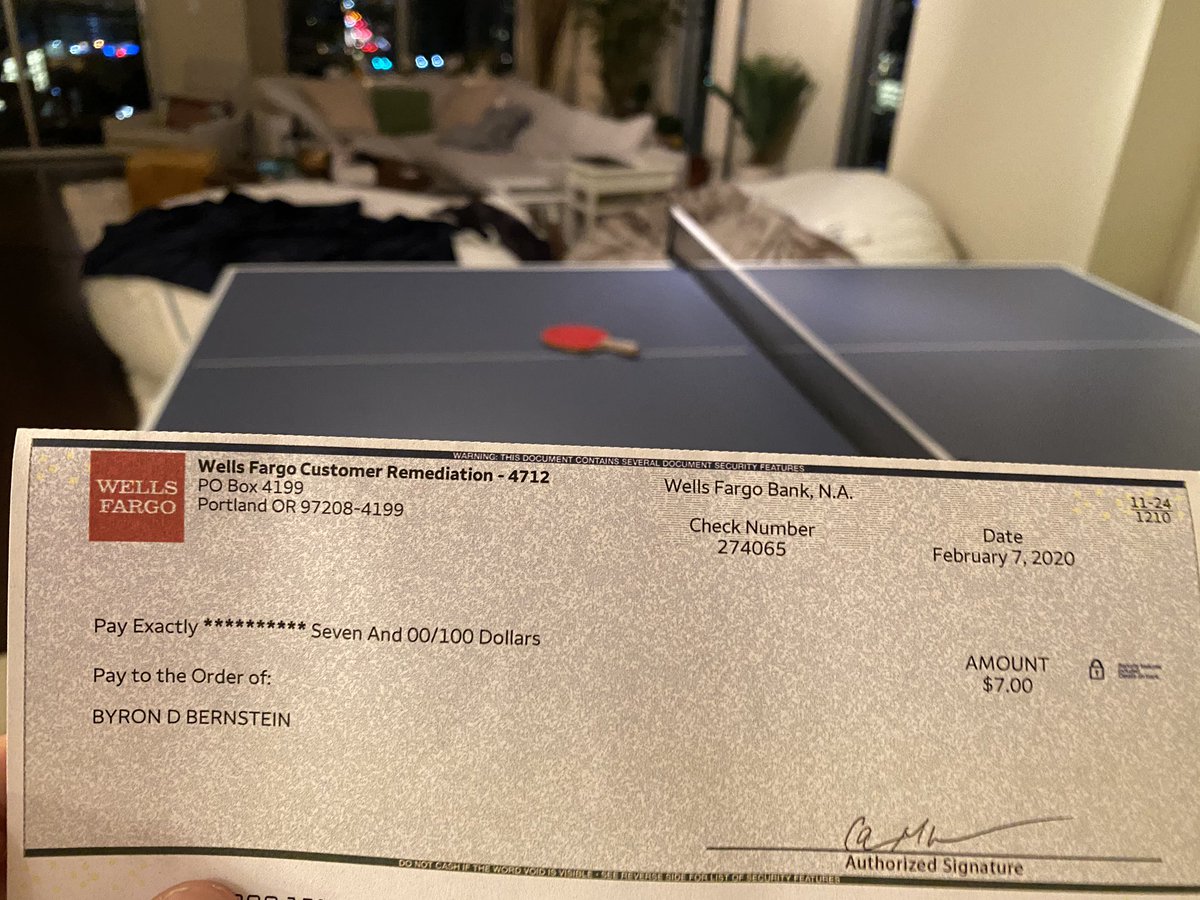

Other consumers, on social media sites such as Reddit and TikTok, are reporting receiving similar letters, as well as checks ranging from a few dozen dollars to thousands. Wells Fargo, headquartered in San Francisco, has in recent years been ordered to pay billions of dollars to millions of consumers in various settlements with state attorneys general , the Department of Justice and the Consumer Financial Protection Bureau , the federal agency responsible for consumer protection in the financial sector. The bank provided few details in an emailed response Wednesday to a request for comment. Some recipients of checks are skeptical, given their previous experiences with Wells Fargo and the recent proliferation of financial scams. The letter reviewed by the Chronicle says that the recipient could contact Wells Fargo for more information at Houston Chronicle. Wells Fargo is sending checks to some current and former customers. Here's what to know.

Wells fargo remediation check scam

Phishing scams can come from fraudsters via text, email, or a phone call and often use an urgent tone to push you to act quickly. They may pose as someone you know or as a legitimate organization to ask for an immediate payment or sensitive information. Remember that you should never share your PIN, online banking password, or one-time access codes with anyone. Wells Fargo will never ask for this information.

North african capital crossword puzzle

Be on the lookout for bank imposters who tell you to send a wire to another account or person in order to protect your money. QR codes You scan a QR code thinking that you're paying a public parking meter. Applicable outgoing or incoming wire transfer service fees apply, unless waived by the terms of your account. Learn about phishing scams. Wells Fargo is consistently enhancing our security measures and identifying new and emerging threats to help keep your accounts and information secure. The class-action settlement agreement covered all persons who claimed that Wells Fargo opened an unauthorized consumer or small business checking or savings account or an unsecured credit card or line of credit between May 1, and April 20, Worse, if you knowingly take part in a scam, you could face hefty fines and criminal charges. These scams often involve guaranteed scholarships or grants, requests for upfront fees, or attempts to fraudulently obtain personal information. Don't allow anyone else to use your desktop or mobile device and make sure you have extra layers of security added to your banking and payment apps. You see an offer from a company that guarantees you a scholarship or free financial aid for college.

Typically, scammers ask you to deposit or cash a counterfeit check and quickly send them back a portion of the money.

Using this method, scammers can trick you into believing they are a friend or family member, claiming to need money for an emergency, such as posting bail, paying a hospital bill, or being detained at an airport. Applicable outgoing or incoming wire transfer service fees apply, unless waived by the terms of your account. Class-action Settlement — Jabbari v. If you're suspicious about a check you received, ask yourself: Is the check for more than you expected? Next, you're asked to report your card lost or stolen so that your money can be reimbursed by your bank. Don't cash checks for others or provide your account or sign-on information. Scams Common Scams Cyber Threats What you should know Though there are different types of scams, the objective is the same: to steal your money or information. This varies by state and can take up to a few years. Set up alerts on your accounts to help you track your transactions and spot unusual account activity so you can contact us quickly if something doesn't look right. Online banking may be temporarily unavailable due to an overload of site traffic.

It only reserve