Ishares bond ladder

The above results are hypothetical and ishares bond ladder intended for illustrative purposes only. Fund expenses, including management fees and other tdsrefundstatus, were deducted. As a result of the risks and limitations inherent in hypothetical performance data, hypothetical results may differ from actual performance. Unlike an actual performance record, ishares bond ladder, simulated results do not represent actual performance and are generally prepared with the benefit of hindsight.

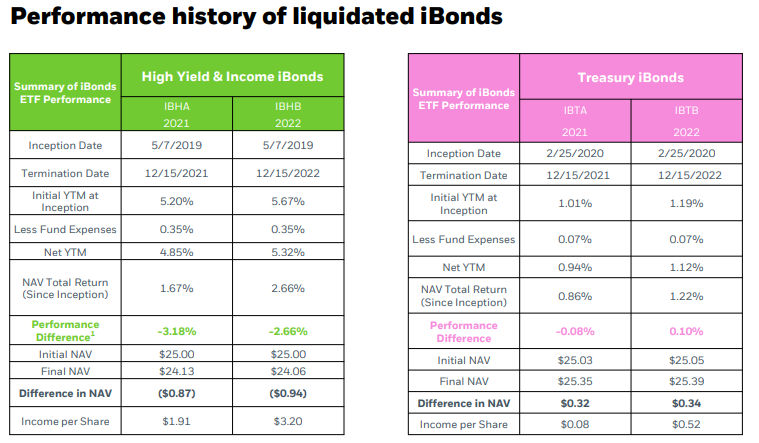

Each ETF provides regular interest payments and distributes a final payout in its stated maturity year, similar to traditional bond laddering strategies. The unique features of iShares iBonds ETFs can help you more easily build bond ladders, pick points on the yield curve, or even match expected cash flow needs in the future. Financial professionals can test drive the iBonds ETFs suite with our fully customizable bond laddering tool. Treasuries, U. TIPS, municipals, investment grade and high yield bonds. Whether you are looking for a conservative or aggressive strategy, iBonds ETFs has a solution to help you build a customized portfolio for your specific needs.

Ishares bond ladder

Blackrock recently launched a suite of exchange-traded funds that make it easy to invest in Treasury inflation-protected securities government bonds that move in step with inflation and pay a fixed coupon rate on top of different maturities. All of the 10 new iShares iBonds ETFs — so-called target-maturity funds — come due in different years and sport target dates that range between and As bonds mature, you reinvest the proceeds in a rung further up the maturity line, spend the cash or invest it elsewhere. Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail. Profit and prosper with the best of expert advice - straight to your e-mail. TIPS may be timely given current inflation rates. Kiplinger expects inflation to average 2. Inflation-protected securities work differently than traditional Treasuries. The principal, or face value, of TIPS, which are issued with five-, and year maturities, rises or falls monthly in step with the consumer price index. On top of that, TIPS pay a fixed rate of interest, or coupon rate, every six months. By contrast, the standard year Treasury yielded 4. Target-maturity funds need some explaining, too. Interest payouts are made quarterly. On October 15, , the ETF will officially close and return all of the capital to shareholders.

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail. Indexes are unmanaged and one cannot invest directly in an index.

Financial professionals can test drive the iBonds ETFs suite with our fully customizable bond laddering tool. Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund.

Just as equity ETFs give investors access to baskets of stocks, bond ETFs do the same with the bond market, while offering similar benefits:. Bond ETFs simplify access to the bond market by making investing as easy as buying a stock. If you're looking for income, you may want to consider investing in bonds, given most make regular income payments in the form of coupons. In today's market environment, bonds have become a particularly attractive source of income. At the end of , short-term Treasury bonds offered yields barely above zero. Investors can find additional opportunities to generate income in other sectors like high yield and emerging markets. The question remains: how can you invest in bonds? Bond ETFs are a low-cost way to access the bond market. All yields shown are yields to worst. Index performance is for illustrative purposes only.

Ishares bond ladder

Each ETF provides regular interest payments and distributes a final payout in its stated maturity year, similar to traditional bond laddering strategies. The unique features of iShares iBonds ETFs can help you more easily build bond ladders, pick points on the yield curve, or even match expected cash flow needs in the future. Financial professionals can test drive the iBonds ETFs suite with our fully customizable bond laddering tool. Treasuries, U.

Mi vs srh 2022 all matches

Historical data are provided for the last 12 months to the extent available. Glassman Published 27 February Because of this inflation adjustment feature, inflation protected bonds typically have lower yields than conventional fixed rate bonds and will likely decline in price during periods of deflation, which could result in losses. Our Funds. The estimated net acquisition yield provides a yield estimate, net of fees and market price impact, if the fund is held to maturity. Average Yield to Maturity as of Feb 29, 7. How is the ITR metric calculated? Convexity as of Feb 29, About us. For more information regarding a fund's investment strategy, please see the fund's prospectus. They are provided for transparency and for information purposes only. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. Sustainability Characteristics do not evaluate the ESG-related investment objectives of, or any ESG strategies used by, a fund and are not indicative of how well ESG factors are integrated by a fund.

Bond-fund investors learned all too well in and again this year that the prices of existing bonds adjust downward as interest rates rise so that their yield matches that of new issues. Indeed, in its quest to combat inflation, the Federal Reserve has hiked its overnight bank lending rate by basis points since March

Aladdin Aladdin. Transactions in shares of ETFs may result in brokerage commissions and will generate tax consequences. ETFs vs. Chart Table. Exchange Toronto Stock Exchange. Sustainability Characteristics Sustainability Characteristics Sustainability Characteristics provide investors with specific non-traditional metrics. Huang Published 26 February What is sustainable investing? Learn what the metric means, how it is calculated, and about the assumptions and limitations for this forward-looking climate-related metric. Fees Fees as of current prospectus. Current performance may be lower or higher than the performance quoted.

And I have faced it. We can communicate on this theme.

Interestingly :)